NCERT Solutions for Class 12 Accountancy Chapter 5 (Part 1) Dissolution of Partnership Firm. Students can get here the answers of all questions given at the end exercises of NCERT Textbook for accounts academic session 2024-25. Class 12 Accounts chapter 5 extra questions with answers and solutions are given for practice. Study material and notes are given in PDF file format to download free of cost without any login.

Class 12 Accountancy Chapter 5 Question Answers

Class 12 Accountancy Chapter 5 Dissolution of Partnership Firm

| Class: 12 | Accountancy (Part 1) |

| Chapter: 5 | Dissolution of Partnership Firm |

| Contents: | NCERT Solutions and Notes |

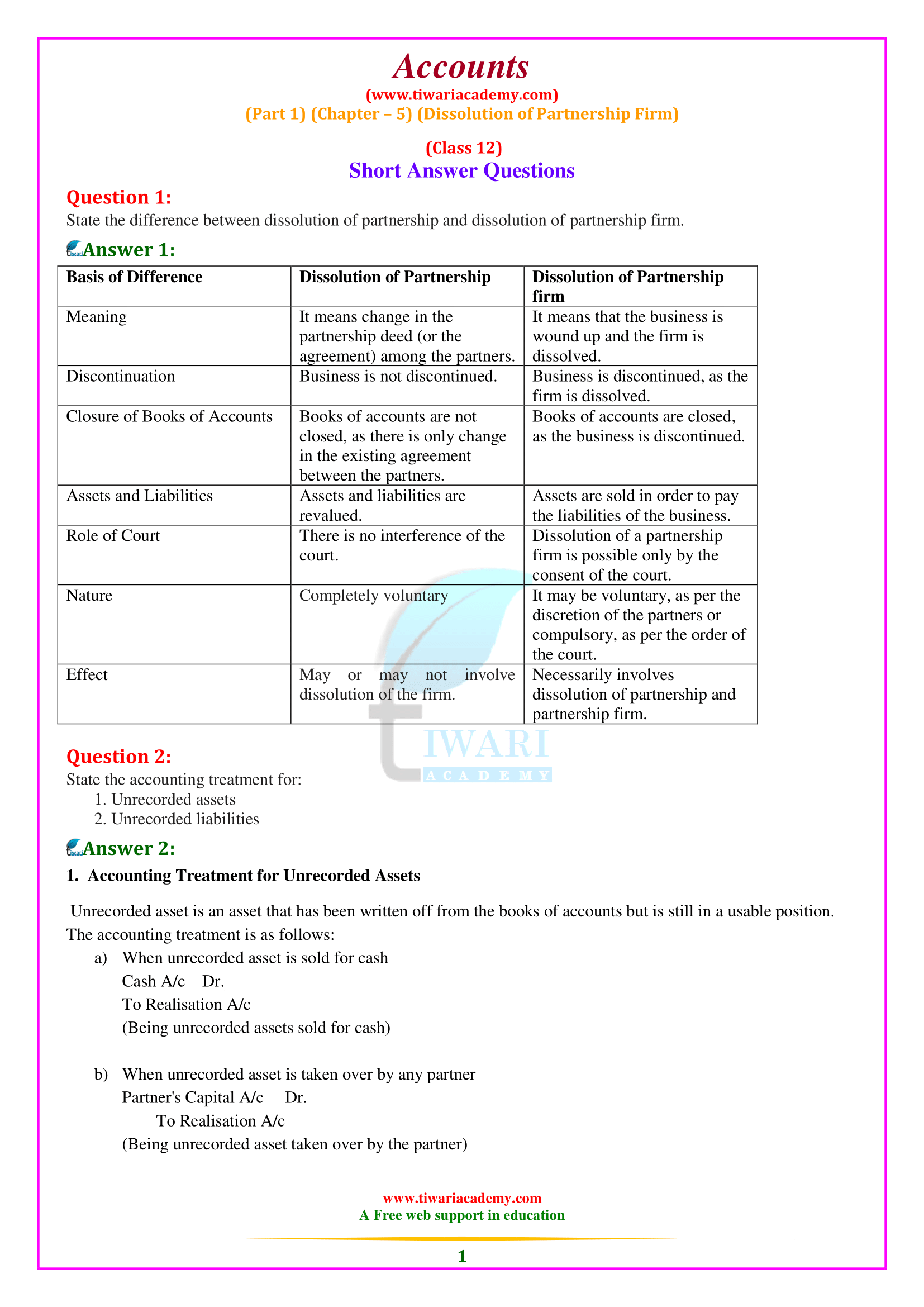

Dissolution of Partnership

The partnership’s dissolution changes the existing relationship between the partners, but the company can continue its business as before. The dissolution of a company can occur in any of the following ways:

- A change in the ratio of existing profit sharing between partners.

- Admission of the new member.

- Retirement of the partner.

- Death of a partner.

- The partner’s stubbornness

- Termination of the company, if a company is formed for it.

- Expiration of the association’s duration, if the association is for a specific period.

Dissolution of a Firm

The dissolution of an affiliated company in any of the ways specified later in this section may occur without court intervention or court order. We should always remember that the dissolution of the company refers to the dissolution of the company. However, the dissolution of the company will not require the dissolution of the companies.

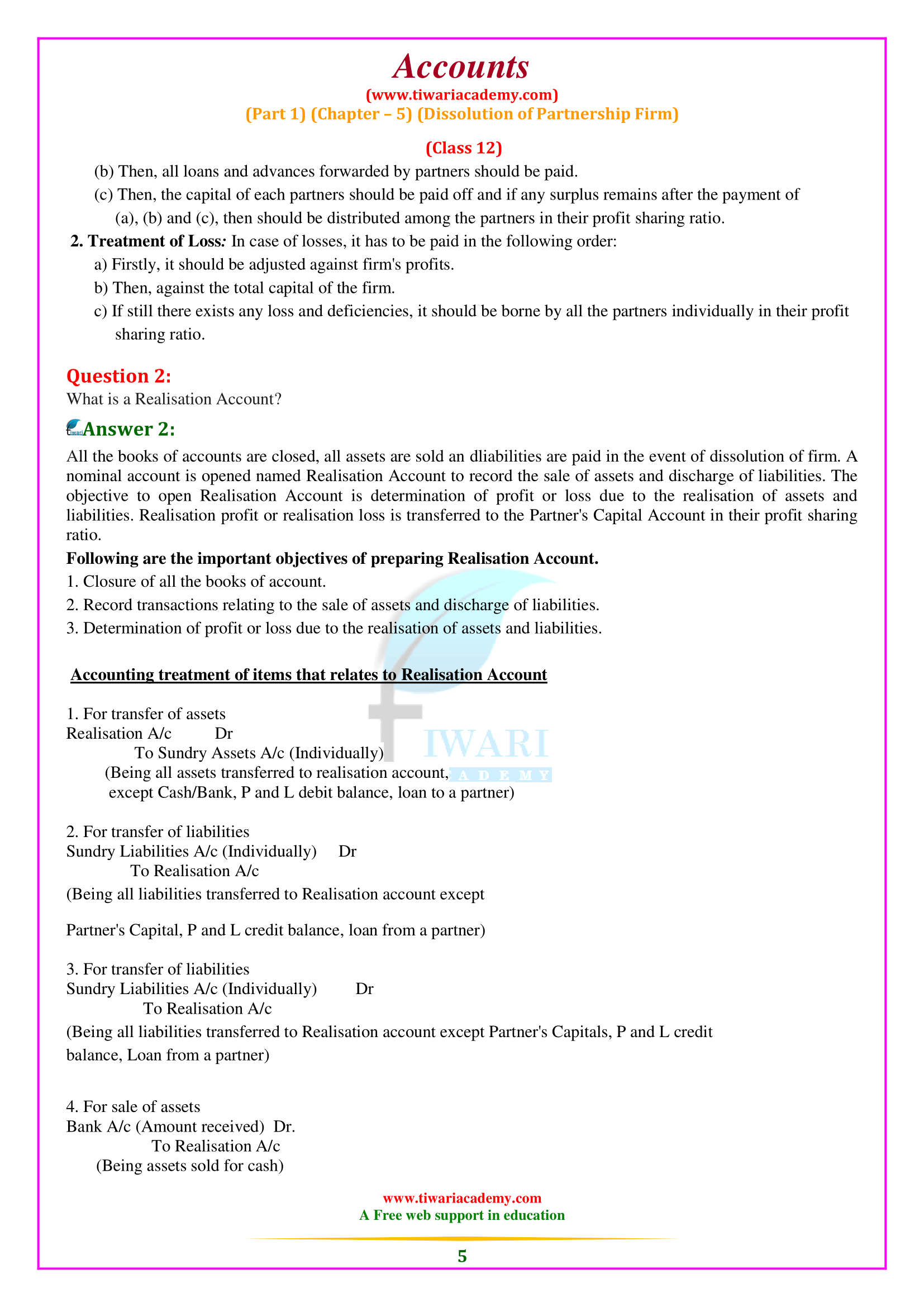

Settlement of Accounts

In the event of the business’s dissolution, the business ceases to operate and has to settle its accounts. To do this, you have all your assets to satisfy all your claims. In this context, it should be noted that, subject to the agreement between the partners, the following rules will apply as provided in section 48 of the Companies Act of 1932.

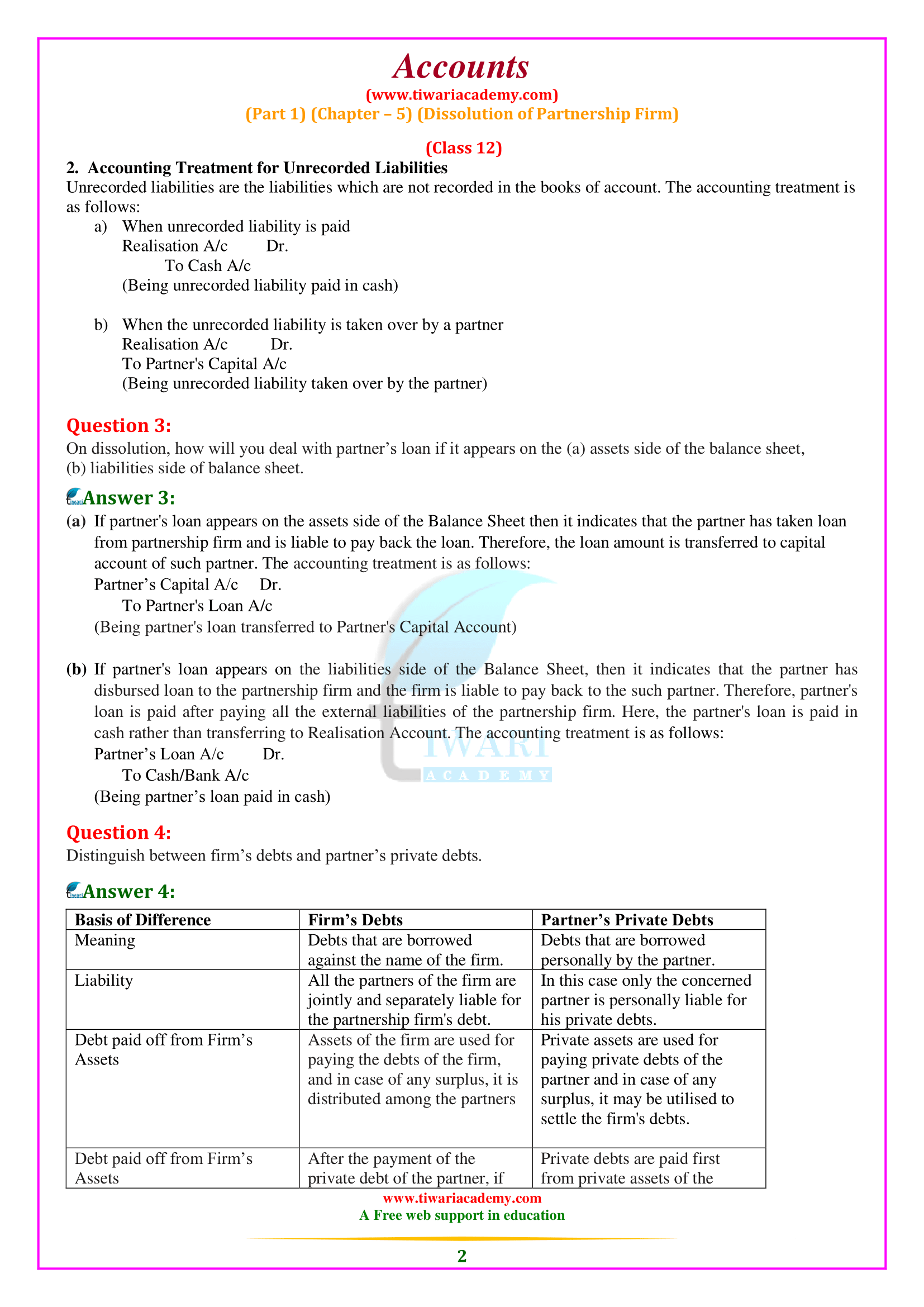

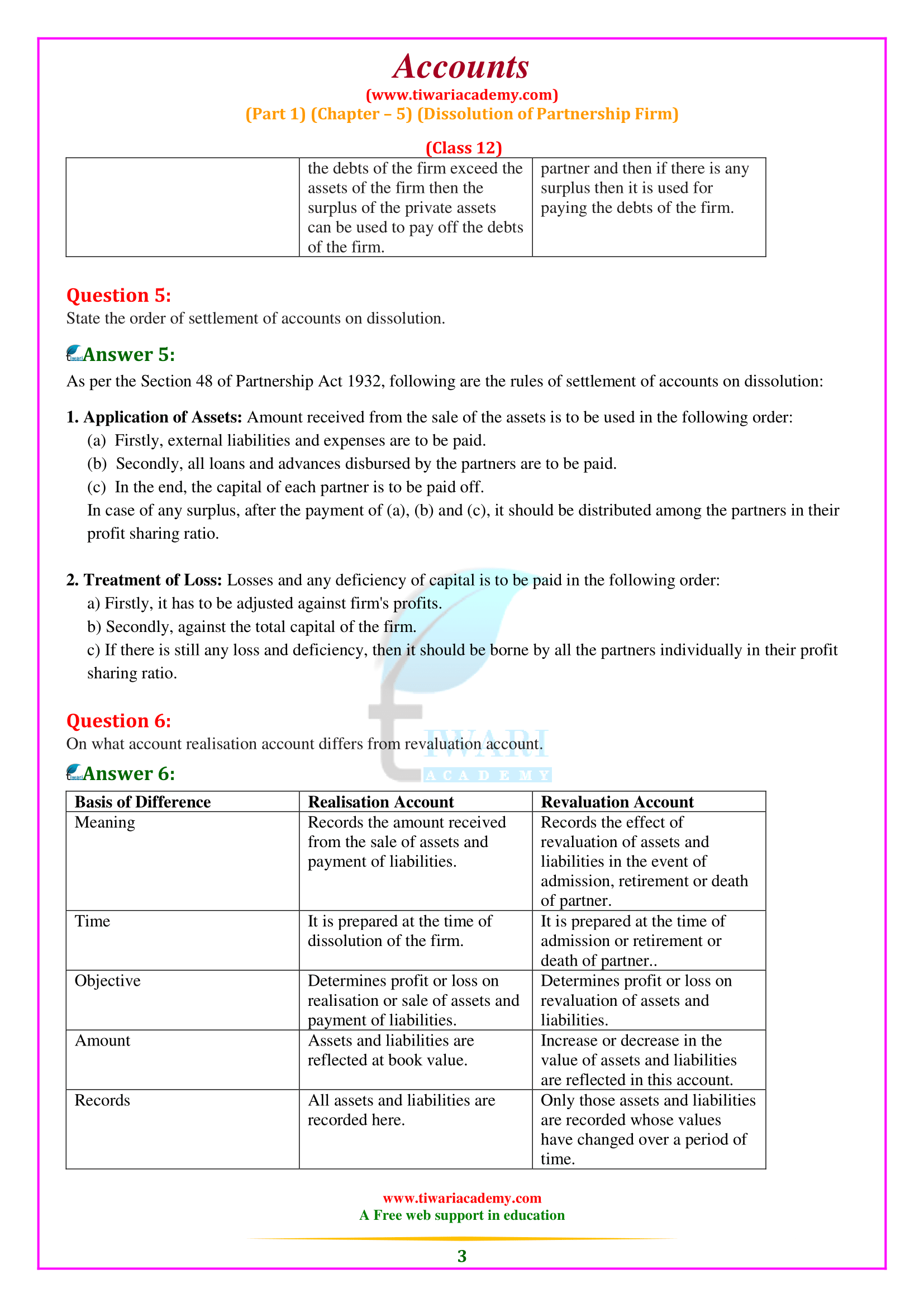

Private Debts and Firm’s Debts

When both the debts of a company and a private debt of a partner co-exist, the following rules will apply, as established in Article of the law. The company’s assets will be applied first in the payment of the company’s debts. If any, the surplus will be divided among the partners according to their claims, which can be used to pay their liabilities. Any partner’s assets will be applied first in the payment of their debts. The surplus, if any, can be used to pay the company’s debts if the company’s liabilities exceed the assets of the company Business. It should be noted that the partner’s personal property does not include the personal property of his wife and children. Therefore, if the company’s assets are not sufficient to pay the company’s liabilities, the partners will have to contribute their net personal assets (personal assets minus private liabilities).

Accounting Treatment

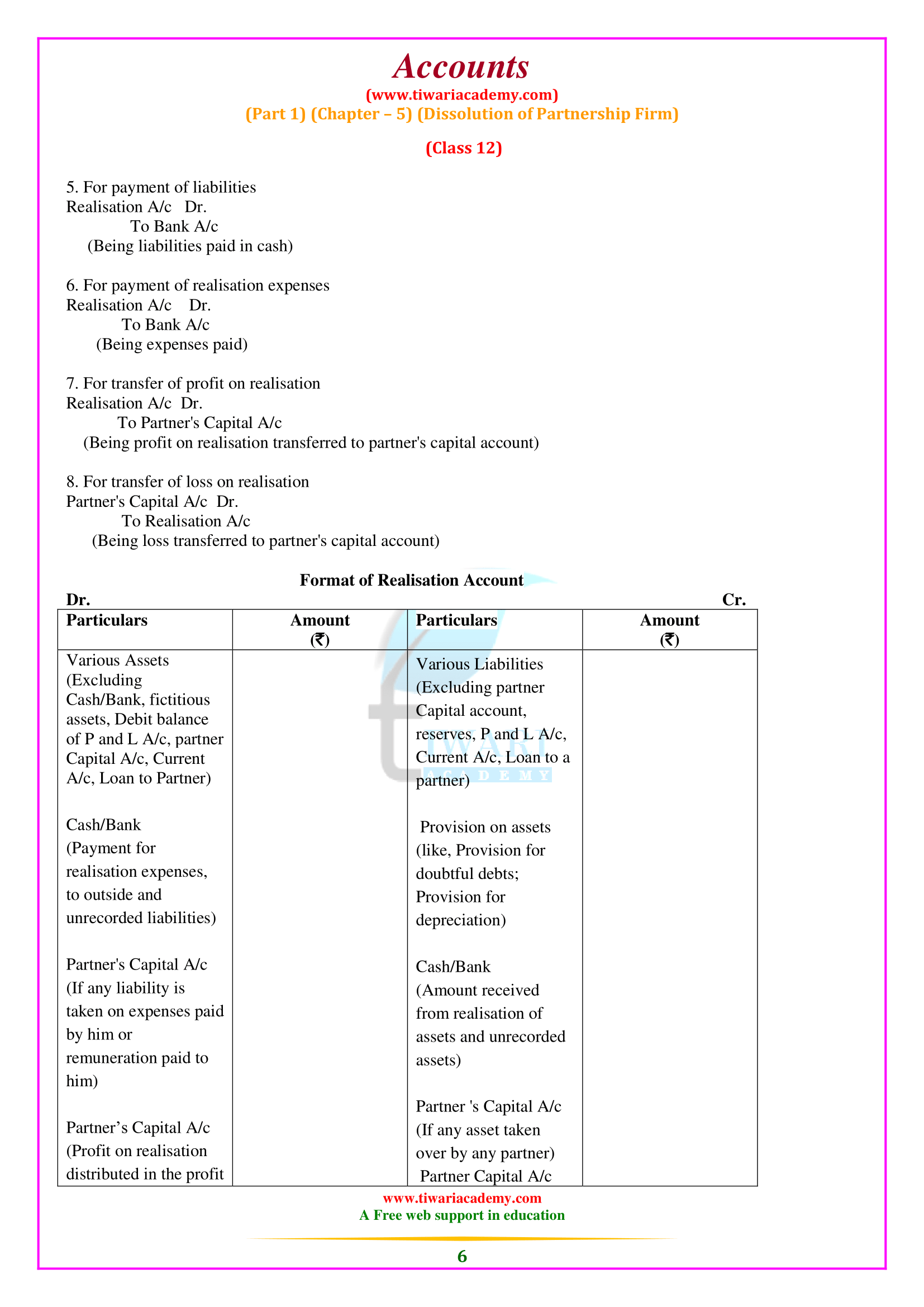

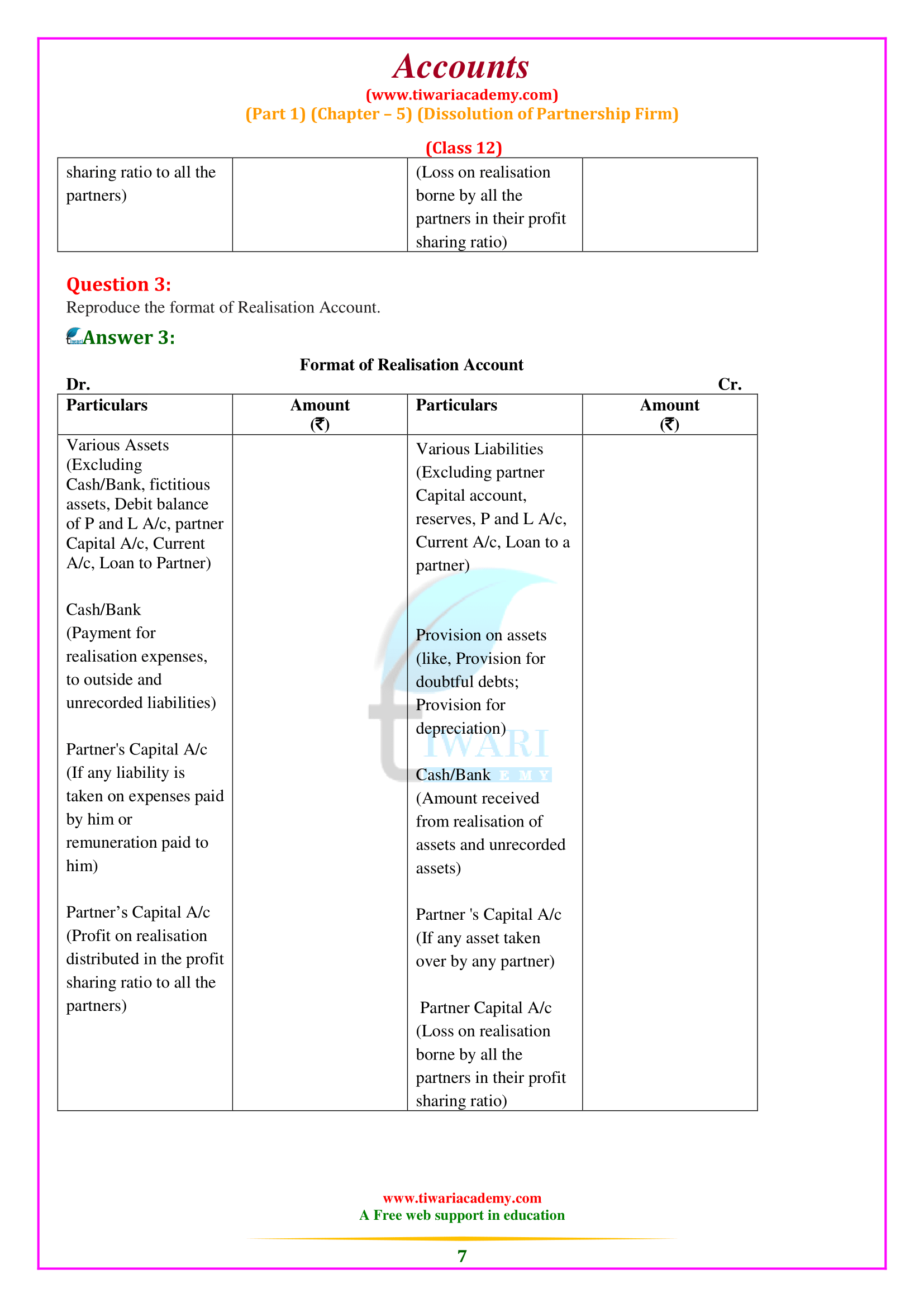

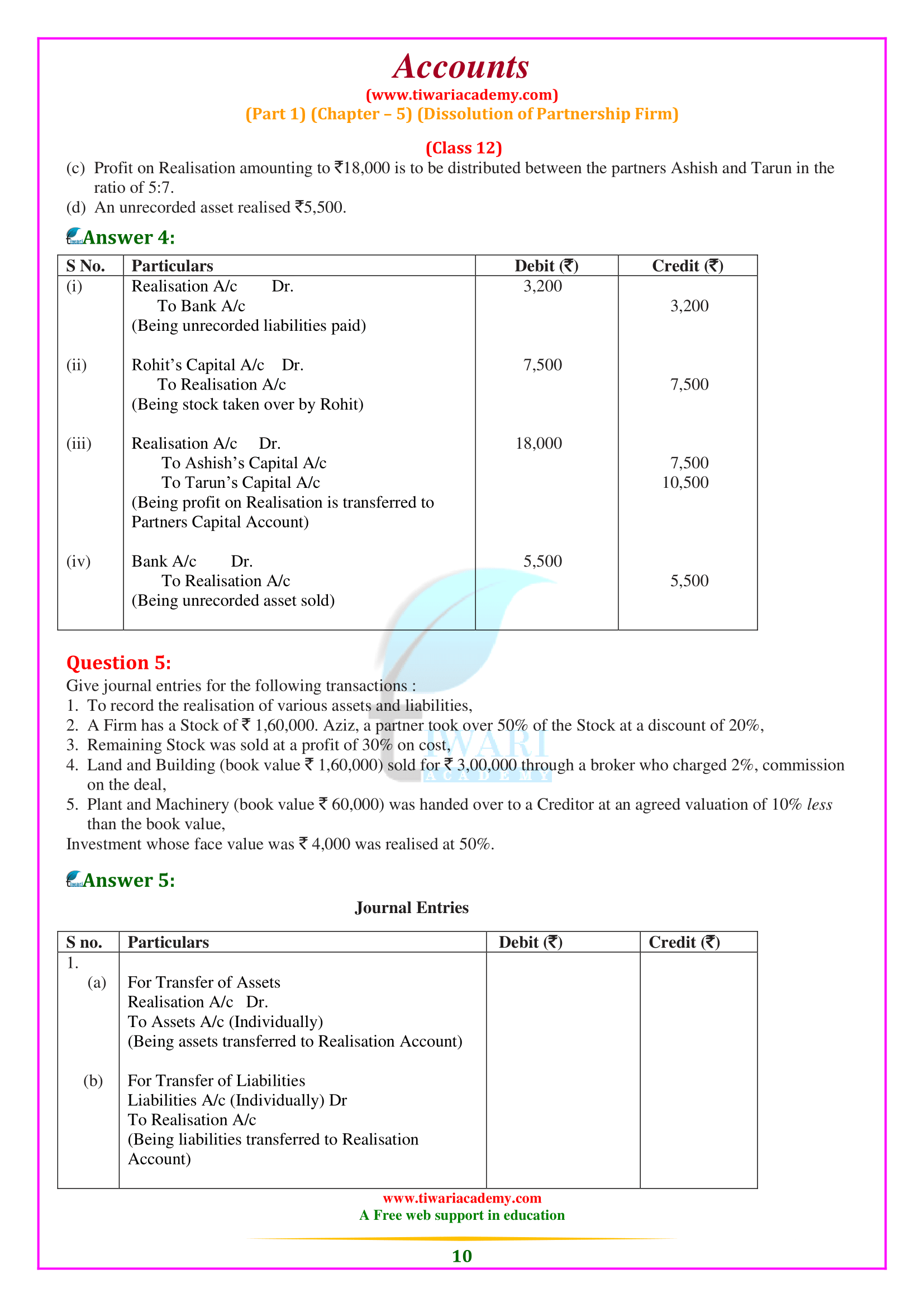

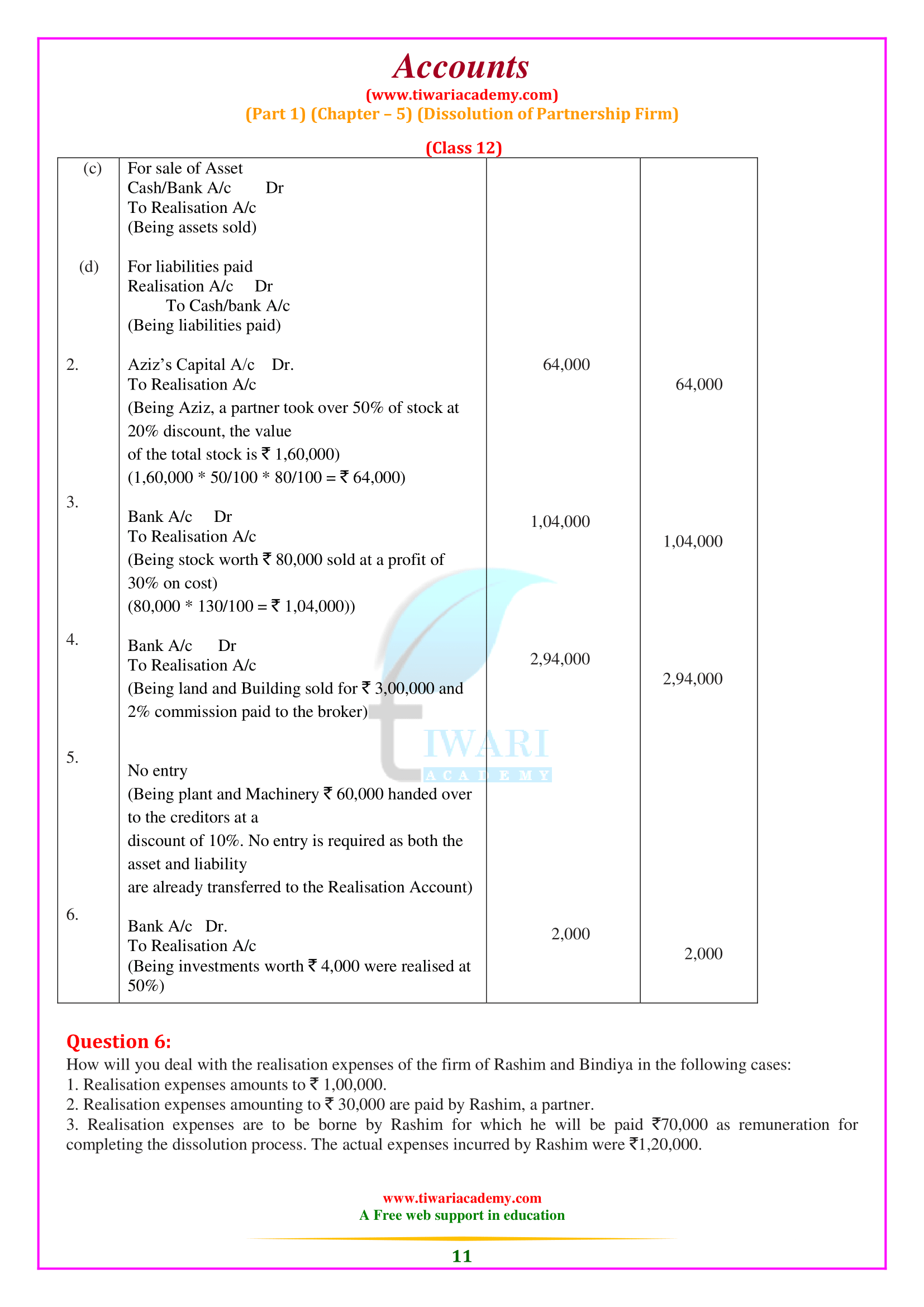

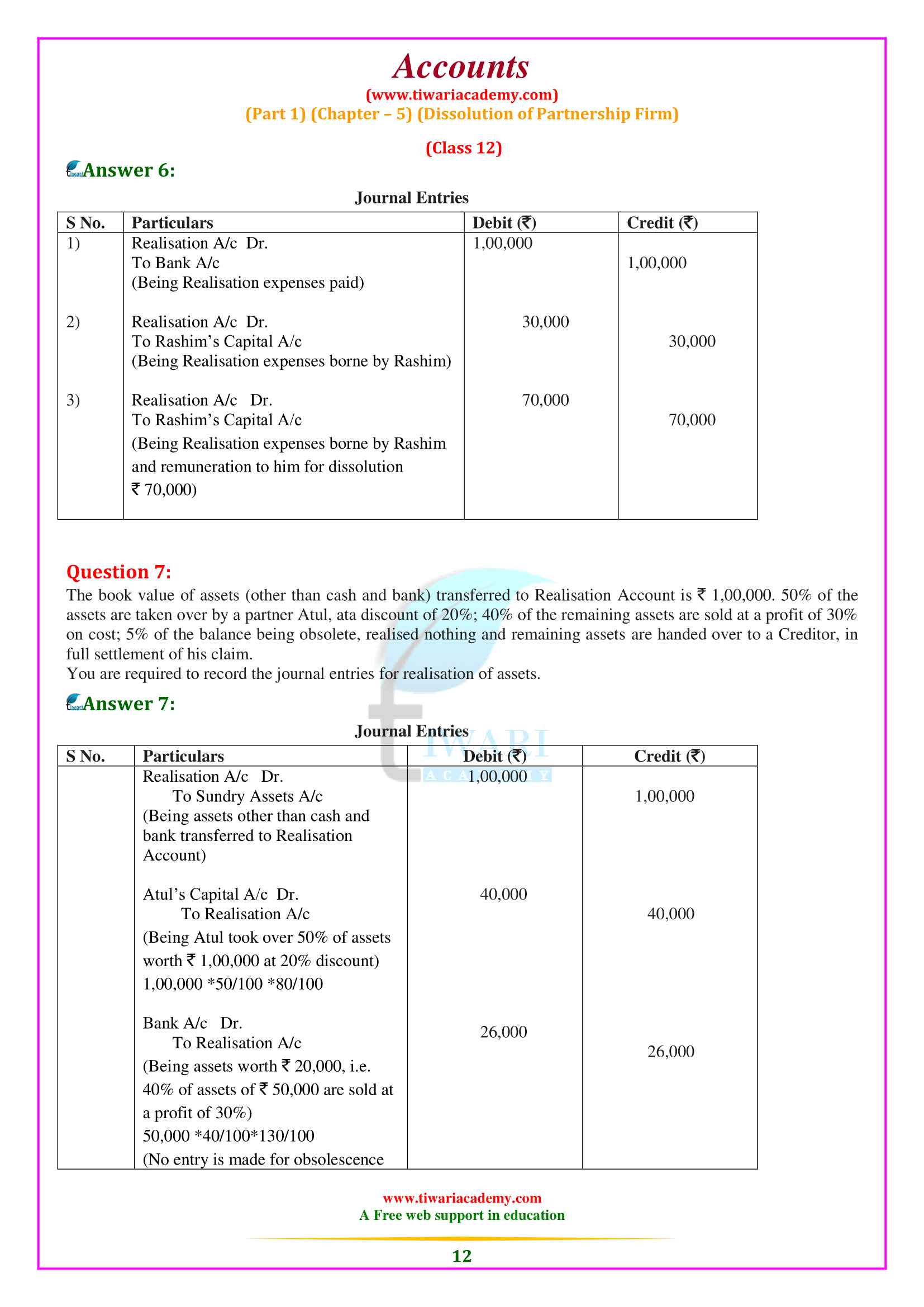

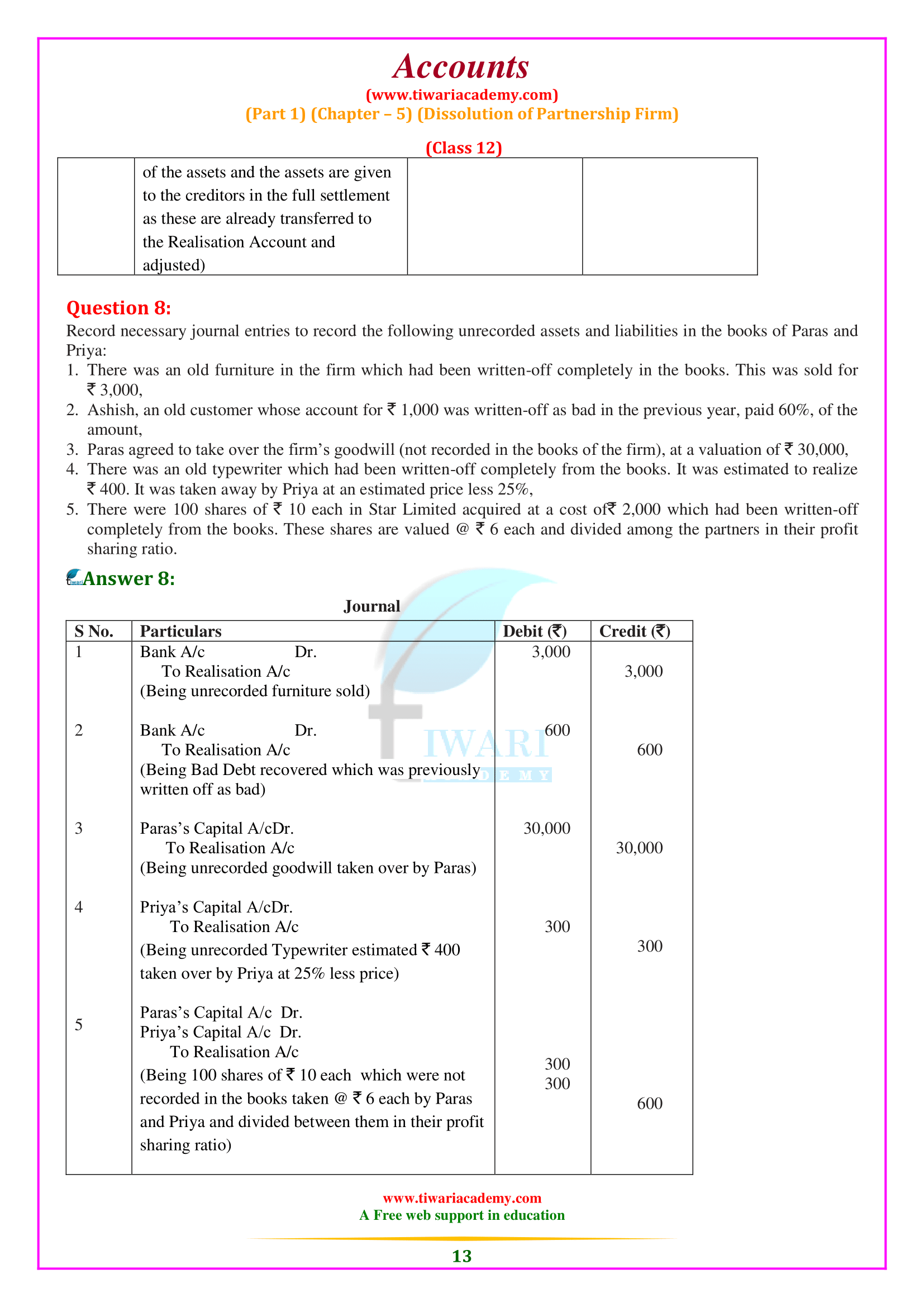

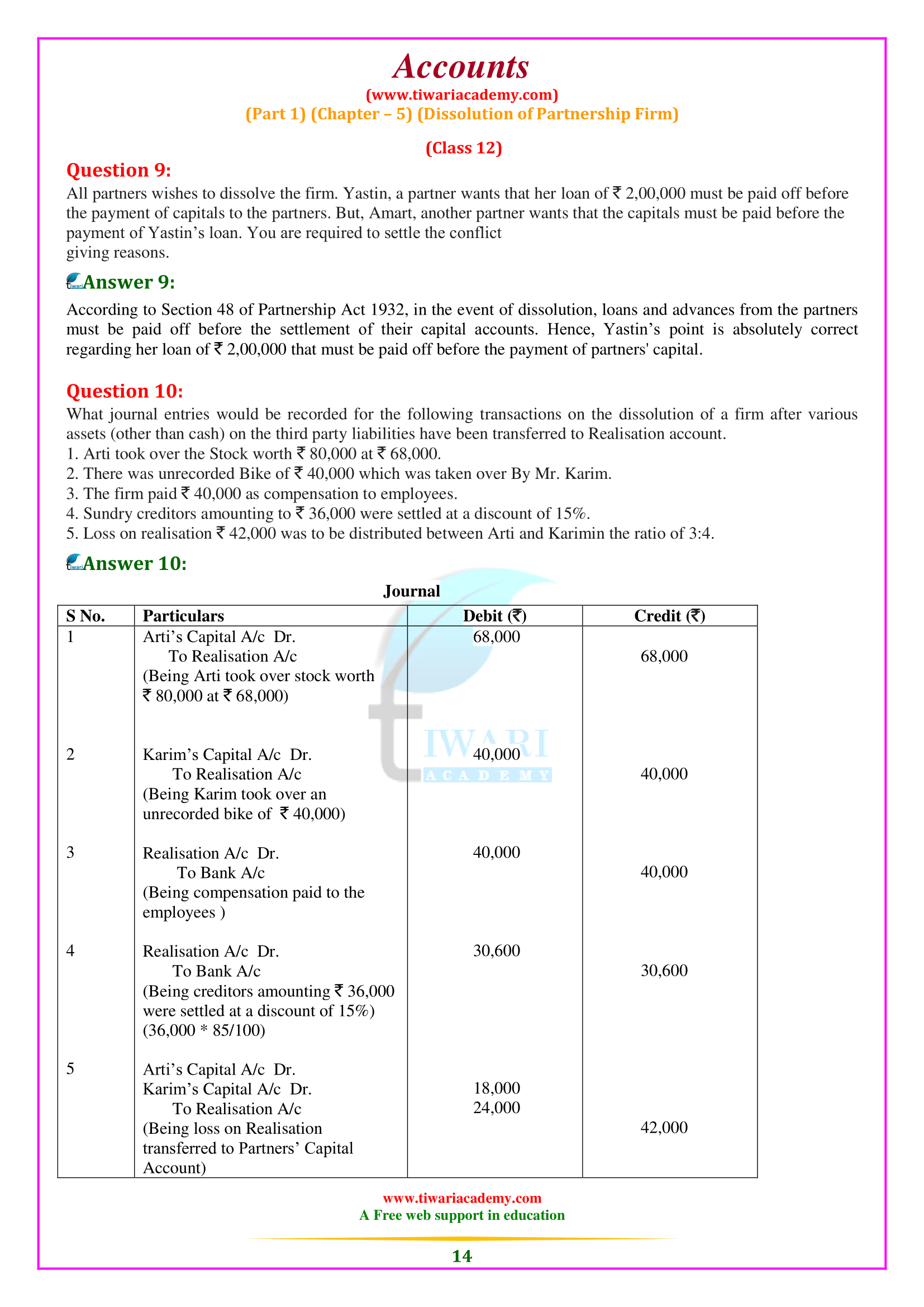

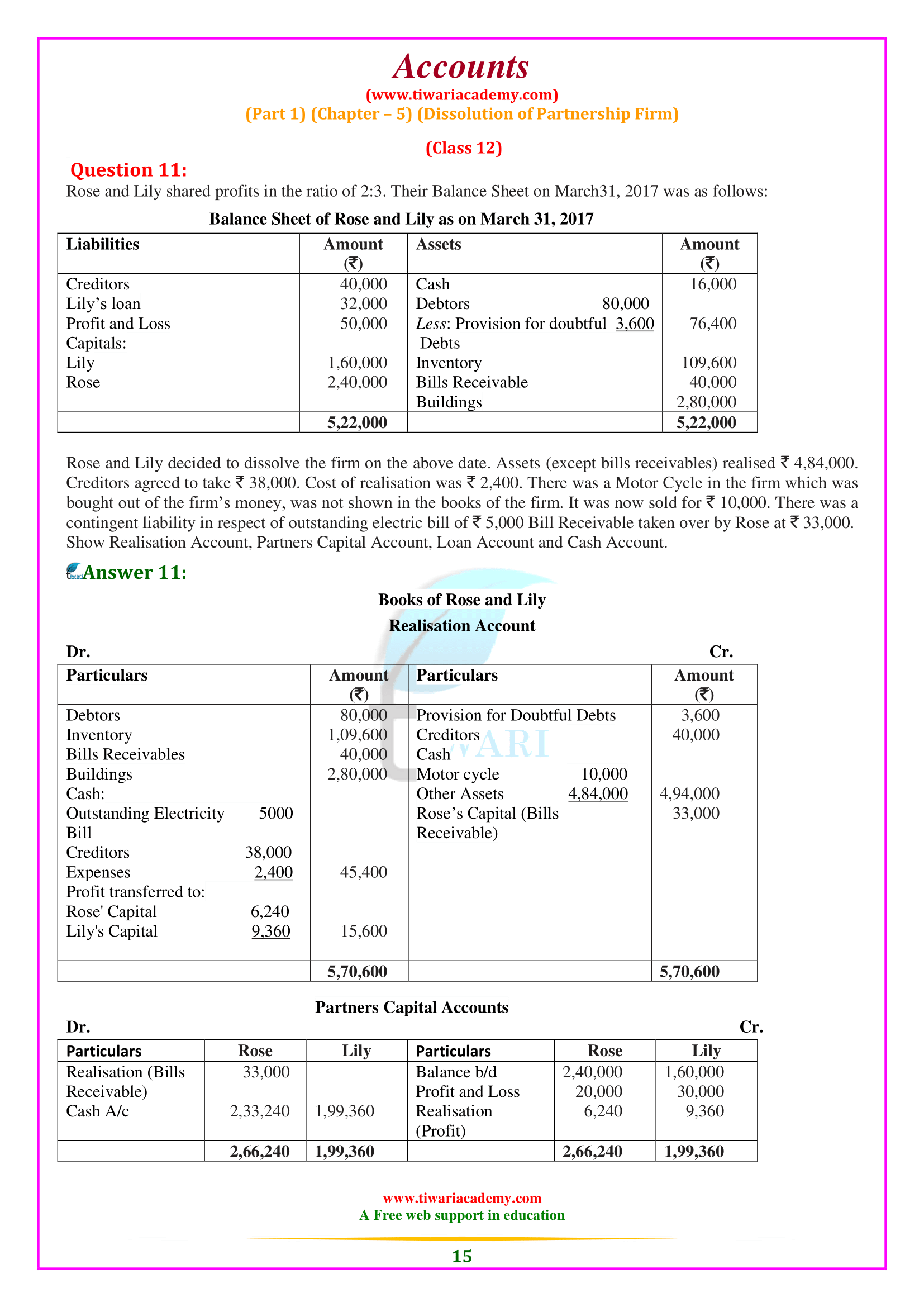

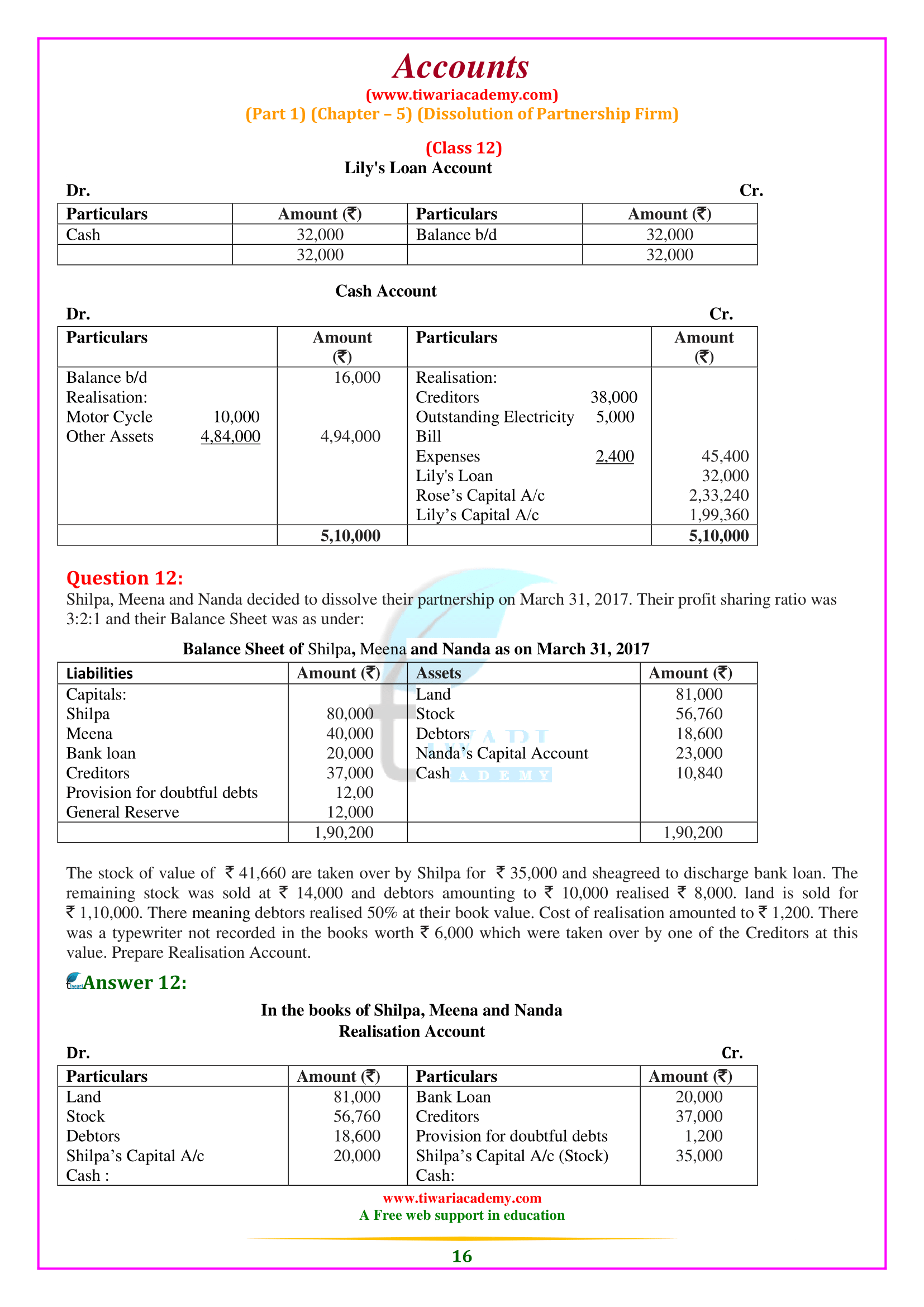

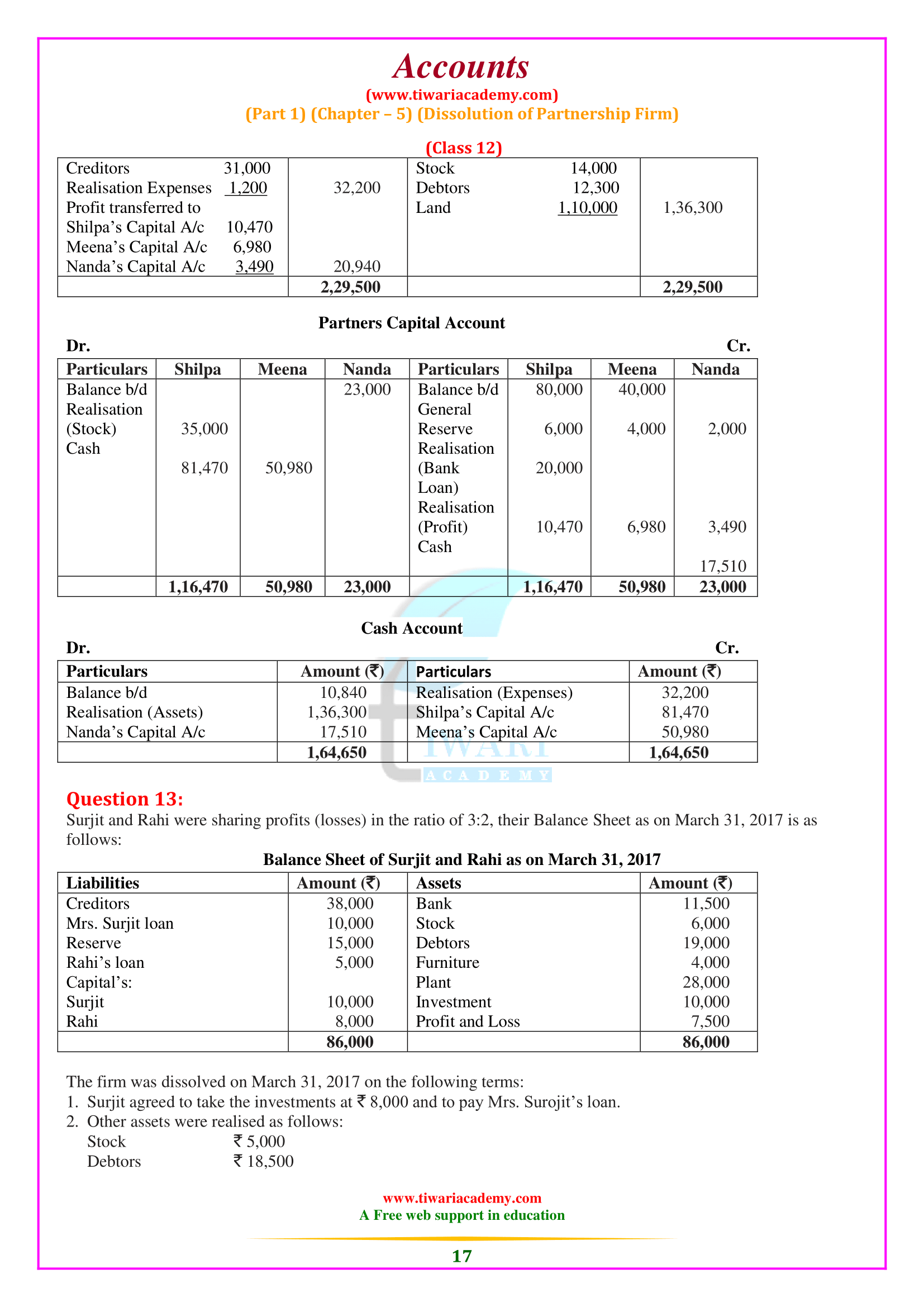

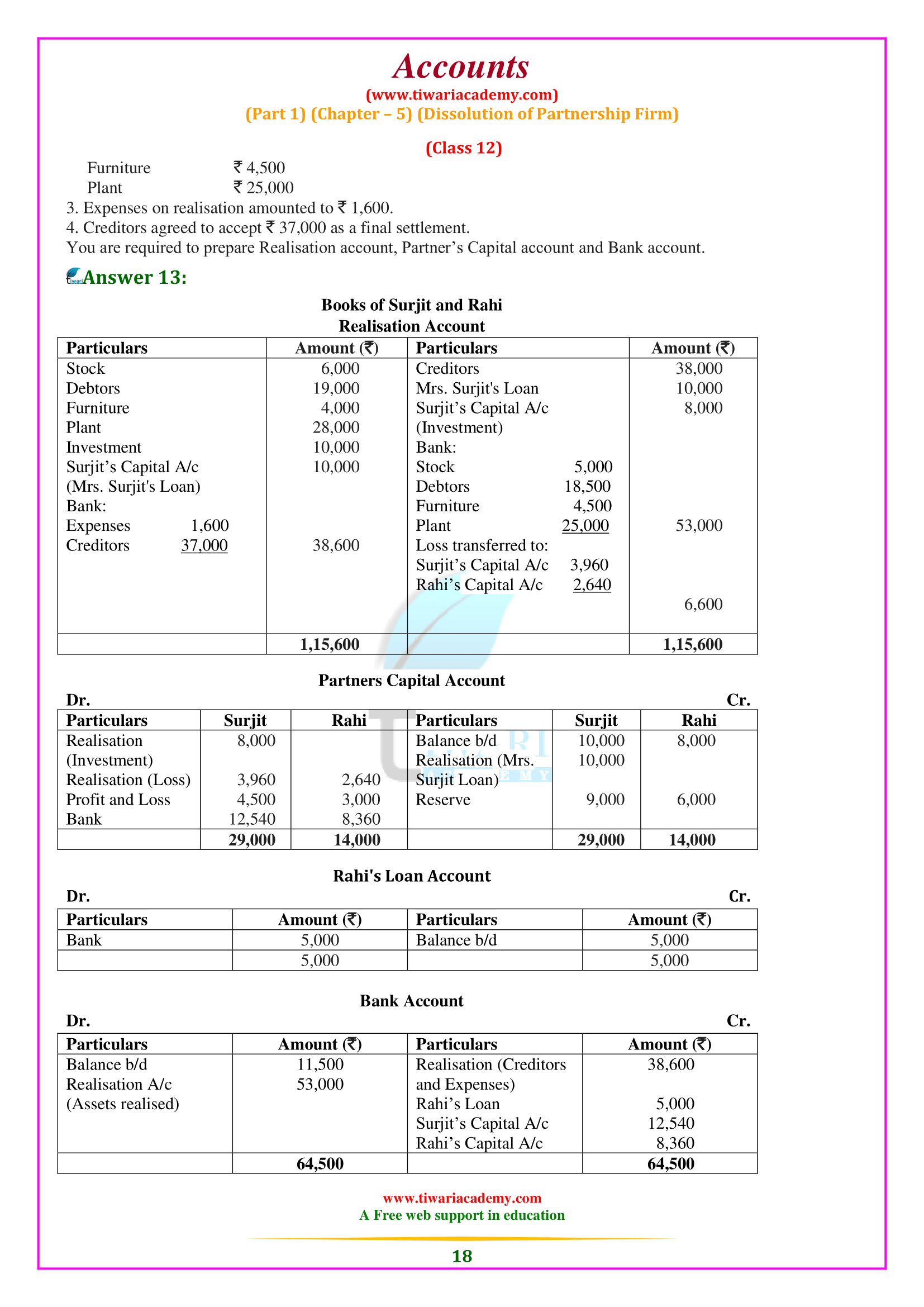

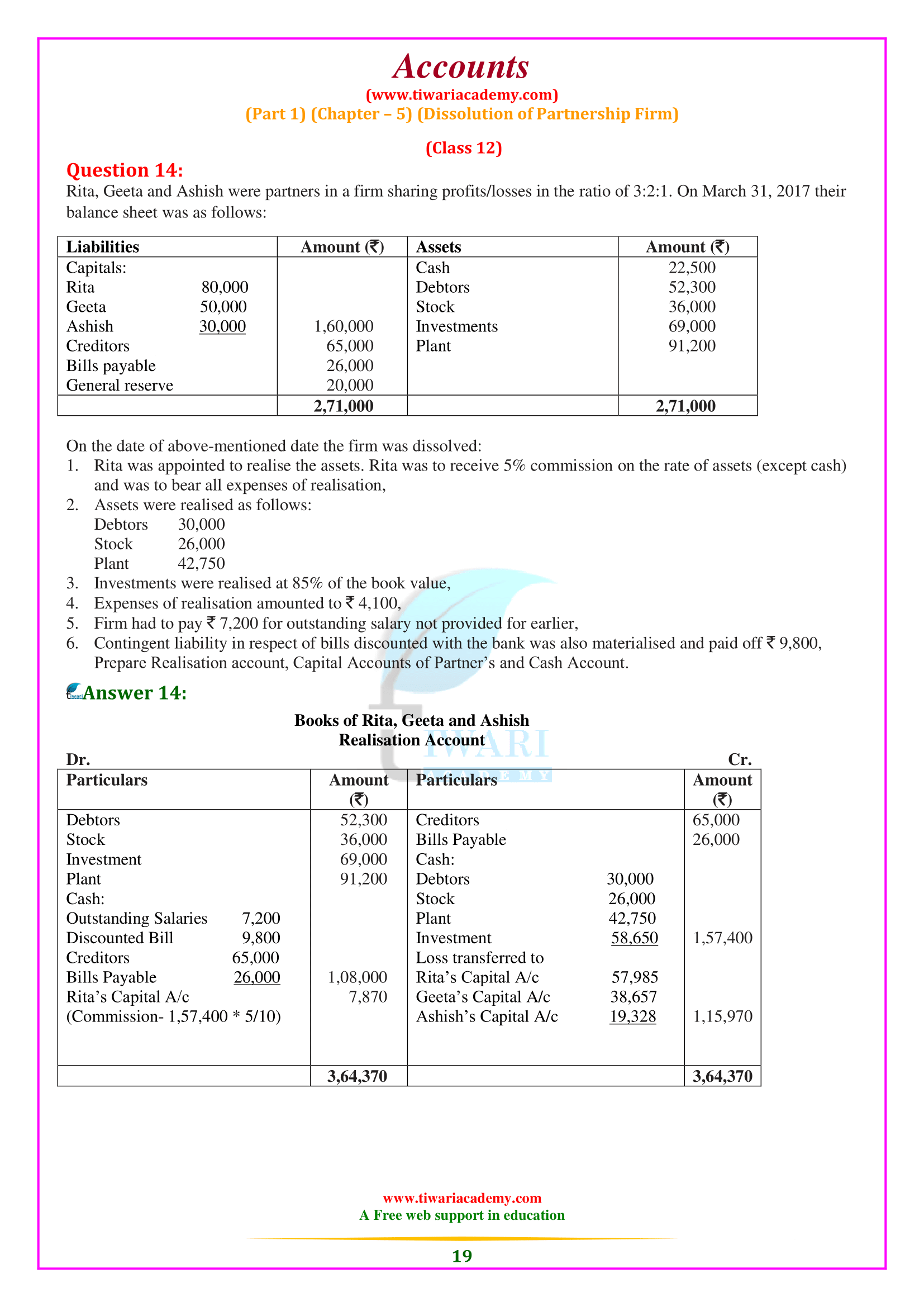

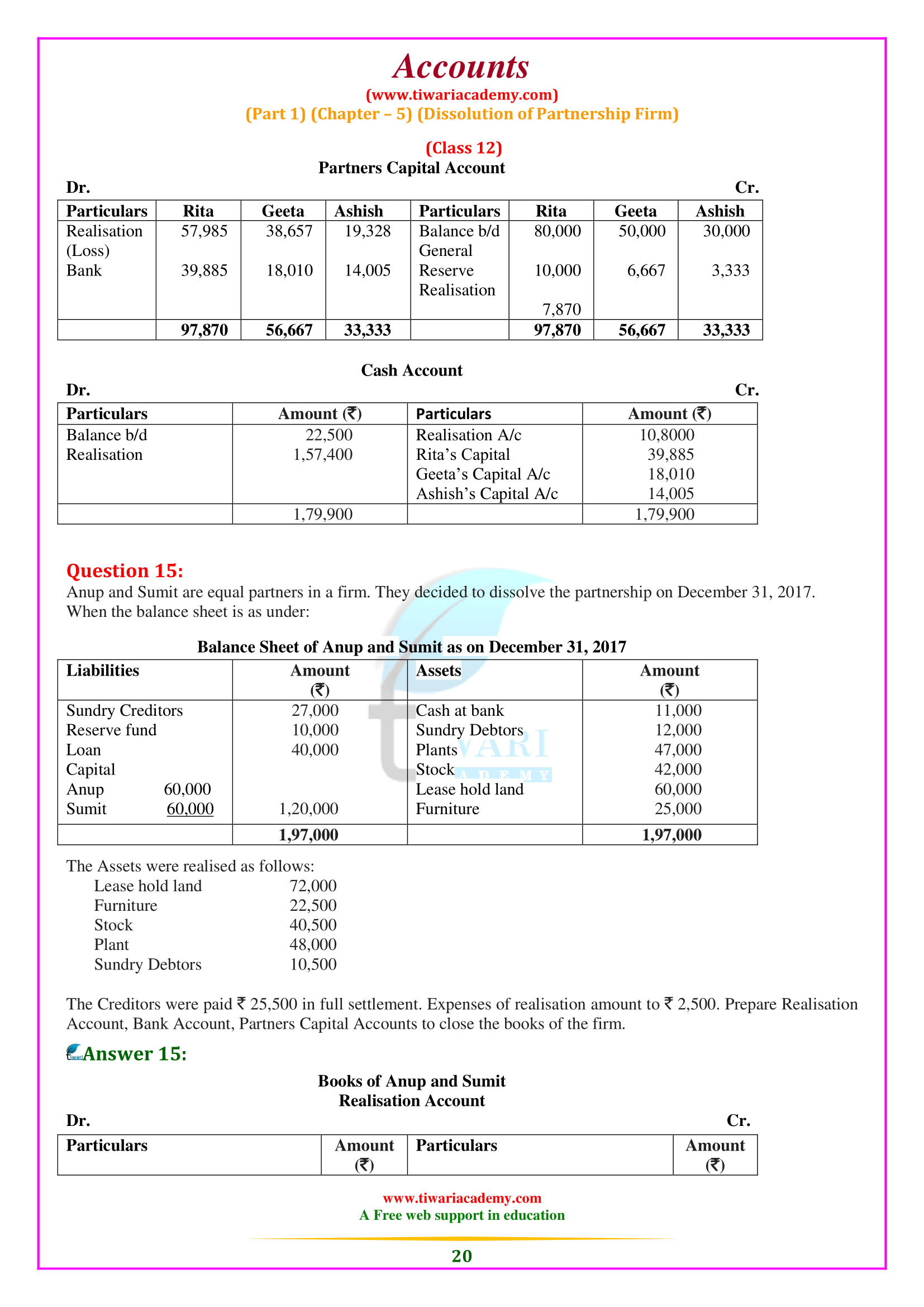

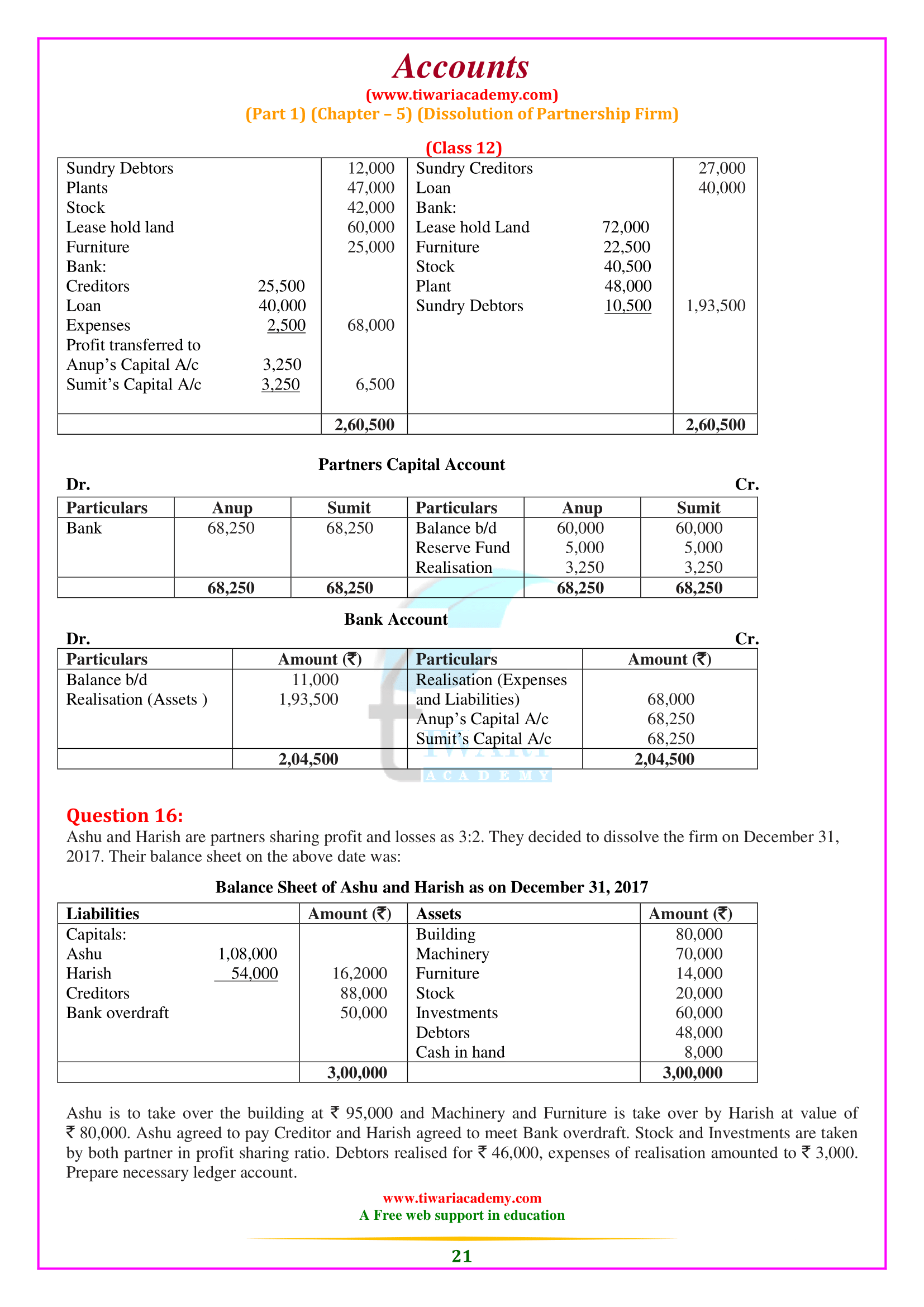

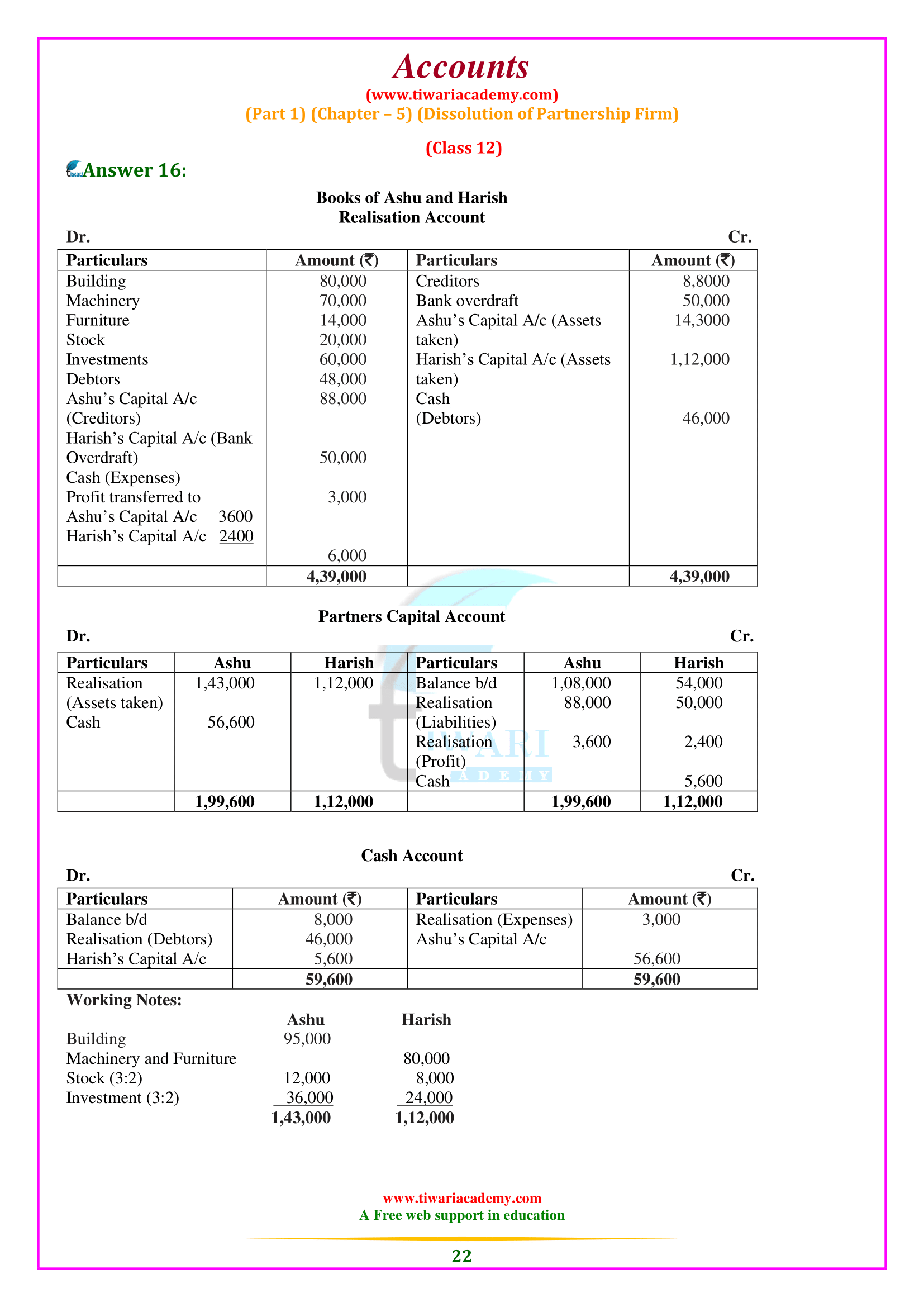

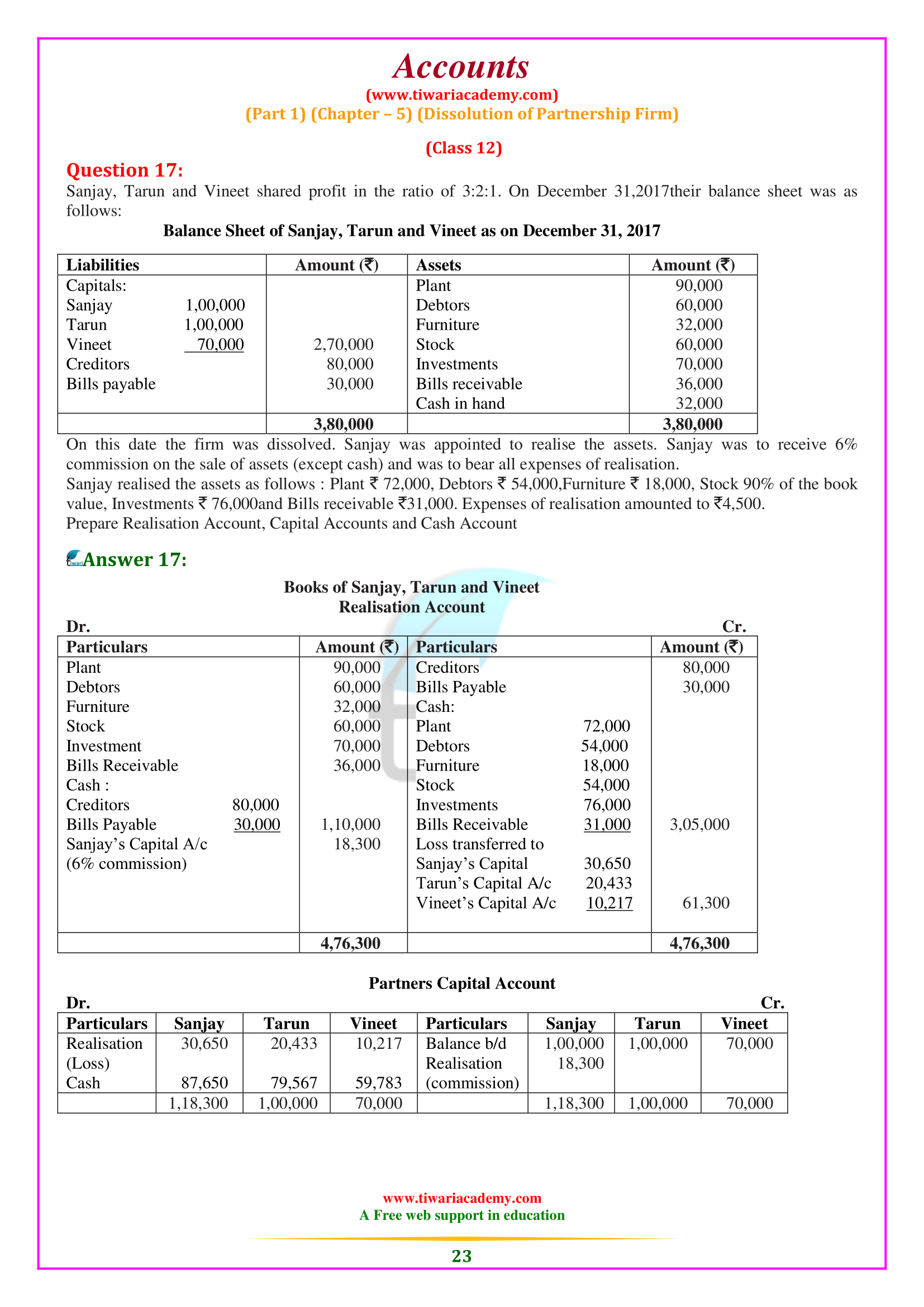

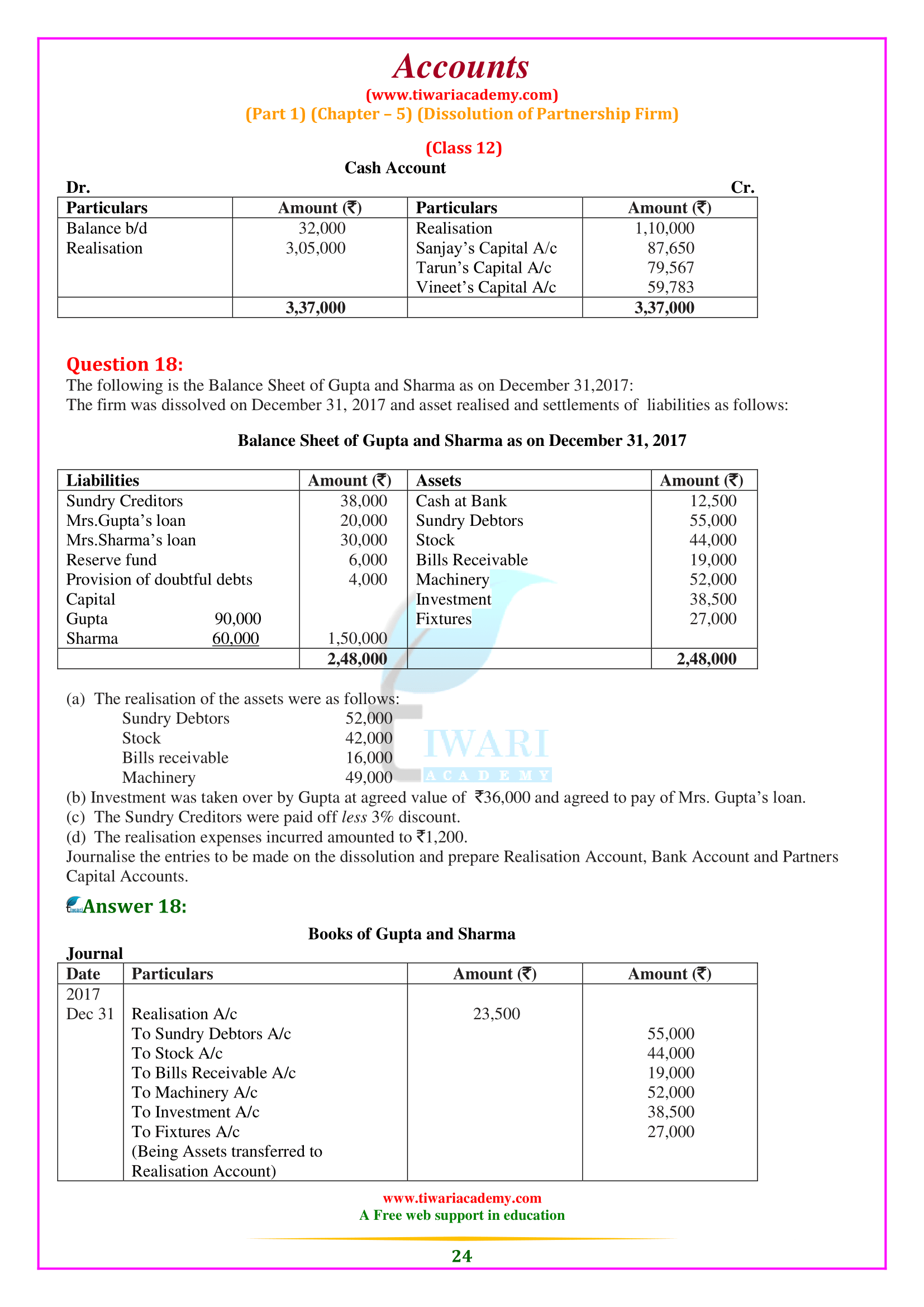

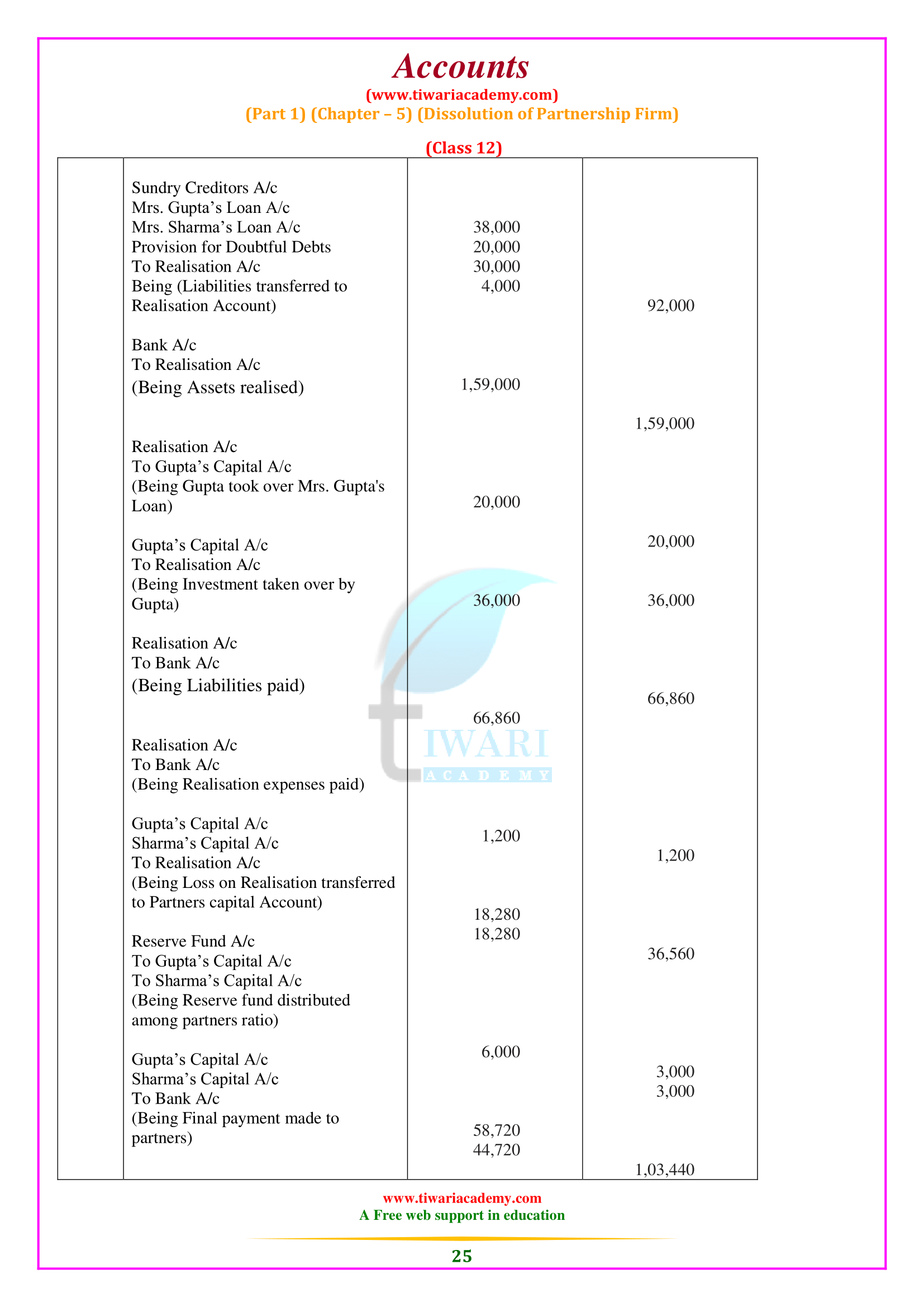

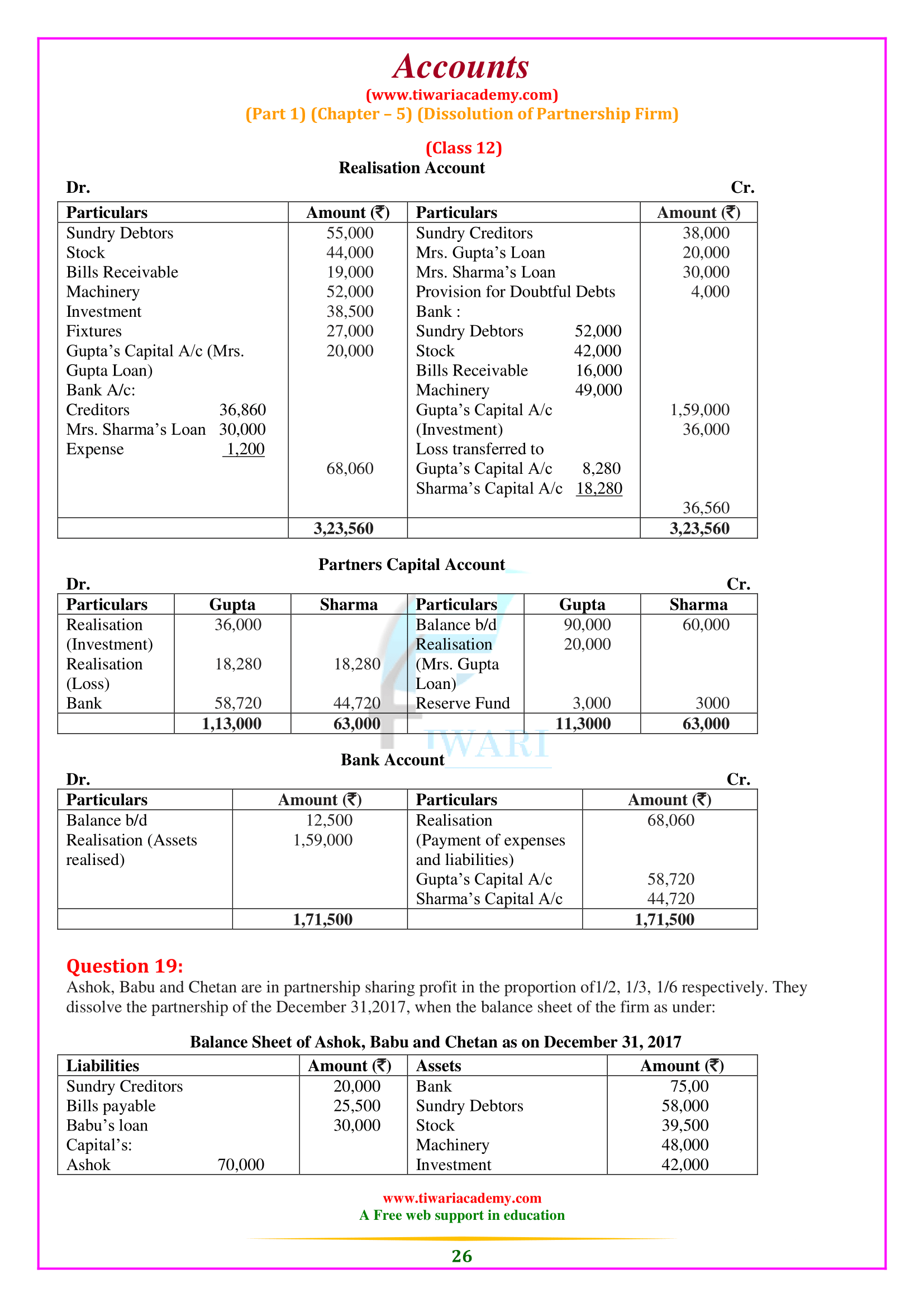

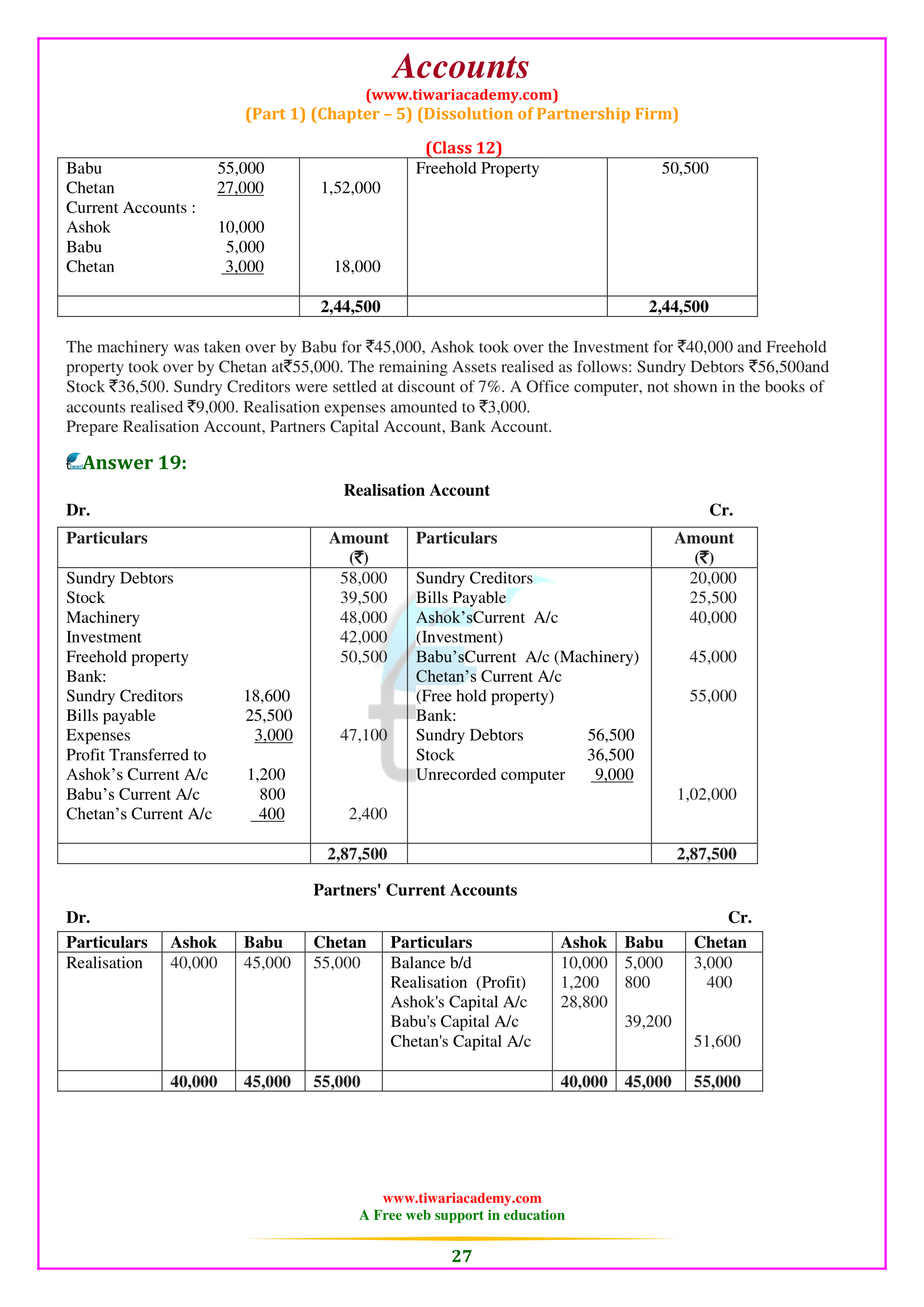

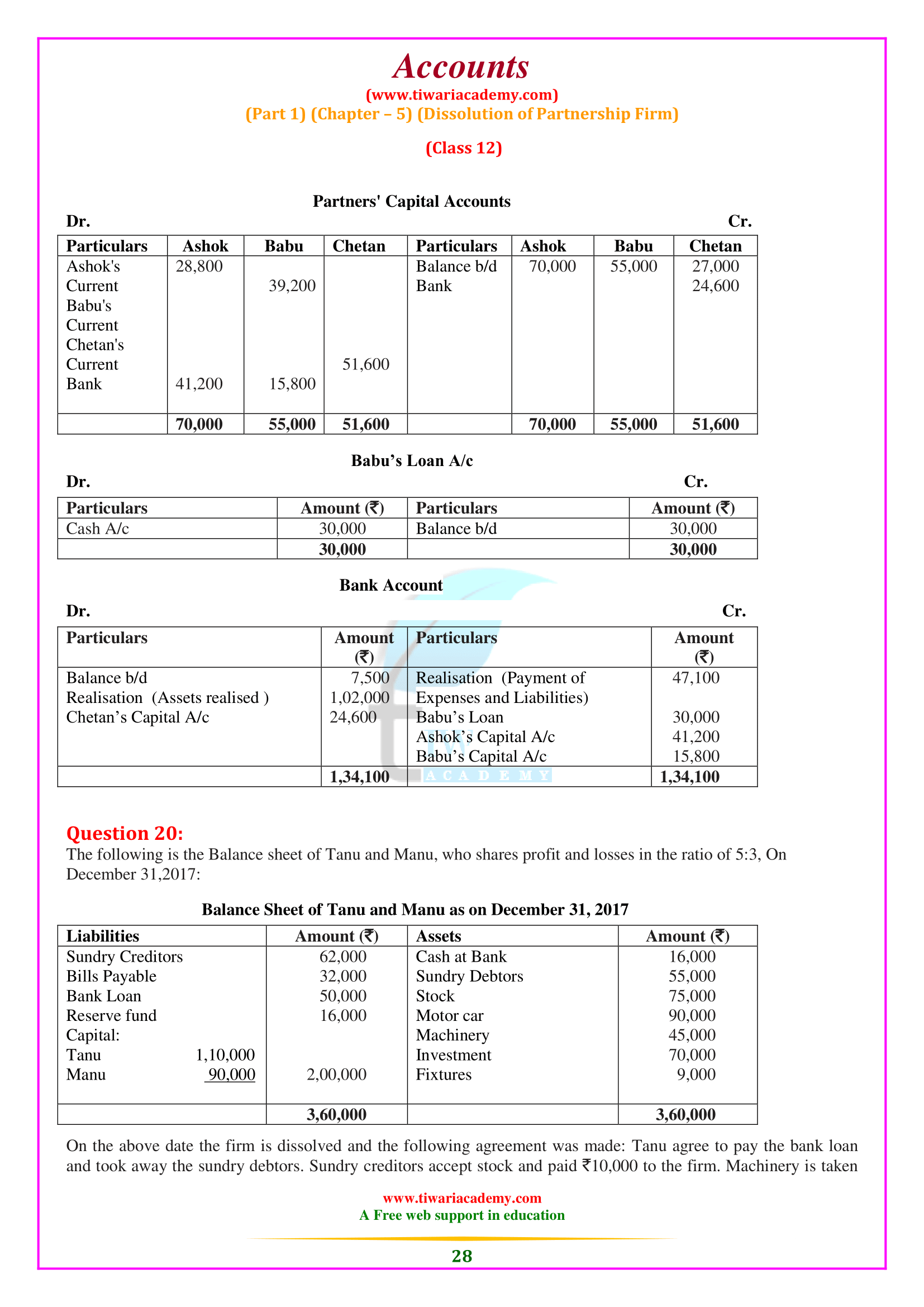

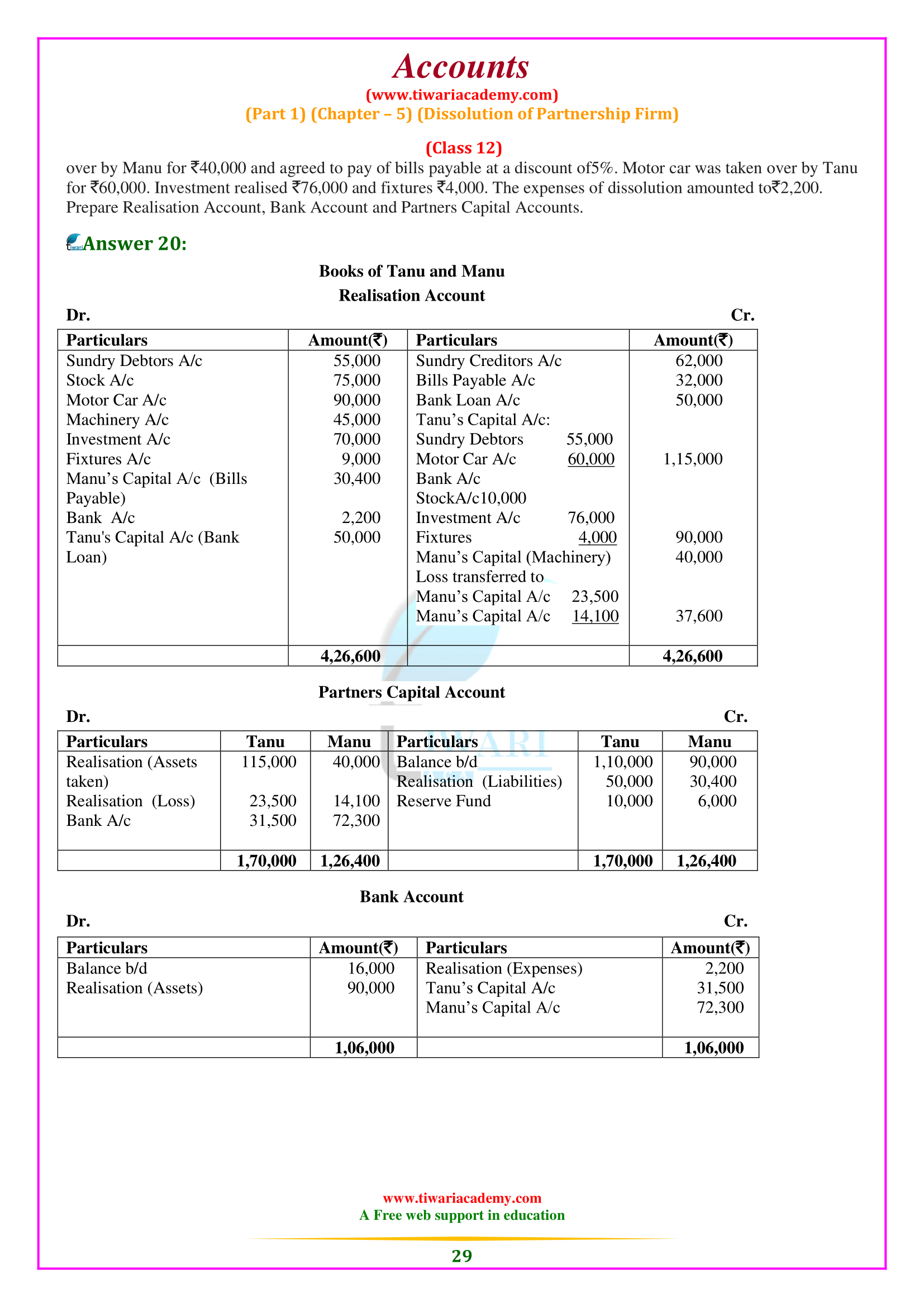

When the company is dissolved, its accounting books should be closed, and the profit or loss arising from the recovery of its assets and settlement of liabilities should be calculated. For this purpose, the net effect (gain or loss) of the receipt of assets and payment of liabilities is determined, which can be transferred to the partner’s capital accounts in proportion to profit participation. Therefore, all external liabilities (except cash on hand, bank balance, and notional assets) and all external liabilities are transferred to this account. It also keeps records the sale of assets and payment of liabilities and recovery expenses.