NCERT Solutions for Class 12 Accountancy Part 2 Chapter 3 Financial Statements of a Company. Questions based on financial statements – numerical and theoretical questions are given here in the form of notes. Along with the CBSE NCERT Textbooks questions, extra questions with answers are also given, which are important for the CBSE exams 2025-26. Practice here with these questions to score a better percentage and clear your doubts related to chapter 2 of part 2 Accounts class 12.

Class 12 Accountancy Part 2 Chapter 3 Question Answers

Class 12 Accountancy Part 2 Chapter 3 Financial Statements of a Company.

| Class: 12 | Accountancy (Part 2) |

| Chapter: 3 | Financial Statements of a Company. |

| Contents: | NCERT Solutions and Notes |

What are Financial Statements?

Financial statements are basic and formal annual reports through which corporate management gives financial information to its owners and other external parties, including investors, tax authorities, Government, employees, etc. These refer to: the balance sheet (statement of position), a company’s profit and loss statement and cash flow statement at the end of the accounting period.

Nature of financial statements

Chronologically recorded facts about events expressed in monetary terms over a specified period of time form the basis of preparation of periodic financial statements that reveal the financial position as a date and Financial results obtained. The American Institute of Certified Public Accountants states the nature of financial statements, “statements prepared with the purpose of presenting periodic reviews of reports on the progress of administration and treating the investment situation in the business and the results achieved.” During the period under review. They reflect a combination of recorded events, accounting principles, and personal decisions.

Main Points of Nature of Financial Statements

Recorded Facts

Financial statements are prepared based on facts in the form of cost data recorded in accounting books. The actual cost or historical cost is the basis of the transaction record. The figures of various accounts like cash in hand, cash in the bank, accounts receivable in accounts receivable, real estate, etc., are taken according to the data recorded in the books of accounts. Assets are purchased at different times, and different prices are grouped and displayed at cost. Since these are not based on market prices, the financial statements do not show the current financial position of concern.

Accounting Conferences

Some accounting conventions are followed in preparing financial statements. The convention of inventory at the price or market price, whichever is lower, is followed. The principle of valuation of assets for balance sheet purposes is refined at a low cost. The convention of materiality is followed when it comes to small objects like pencils, pens, postage stamps, etc. These terms are considered an expense in the year they are acquired, even if they are active. The stationery price is on cost and not according to cost or market price theory, whichever is lower. The use of accounting conventions makes financial statements comparable, simple, and realistic.

Postulates

Financial statements are prepared on some basic assumptions (prerequisites), known as documents, such as a post office concern, money measurement postulate, receipt post out, etc. It is considered a concern that the business is considered a concern and exists for a more extended period. Therefore, assets are shown on a historical cost basis. The measure of wealth indicates that the value of money will remain the same over different periods. Although there is a drastic change in the purchasing power of money, the property purchased at different times will be displayed at the amount paid for them. Whereas, while preparing the income statement, the income is included in the sale of the year the sale was made, although the sale price may be received for several years. The notion is known as pratiksha.

Personal decisions

In more than one circumstance, the facts and figures presented in the financial statements are based on personal opinions, estimates, and judgments. Depreciation is provided, taking into account the useful economic life of fixed assets. Provisions for doubtful loans are made based on estimates and personal decisions. When evaluating inventory, cost, or market value, whichever is lower is followed. When deciding the inventory’s cost or the market value of the inventory, several individual decisions must be made based on some considerations. Considering the liabilities of assets, opinions, decisions, and personal estimates are made when preparing financial statements to avoid redundancy of assets and liabilities, income, and expenses.

Types of financial statements

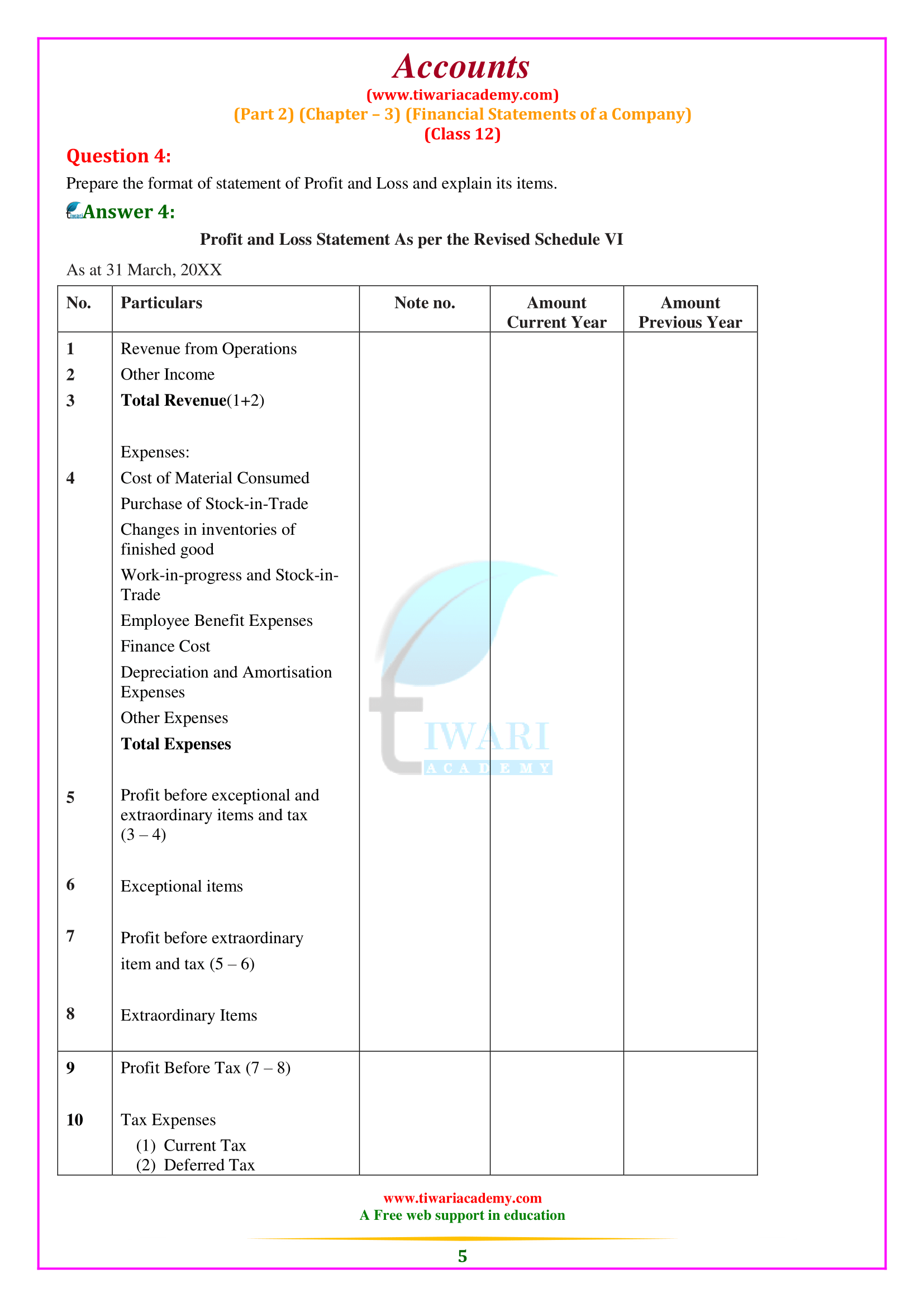

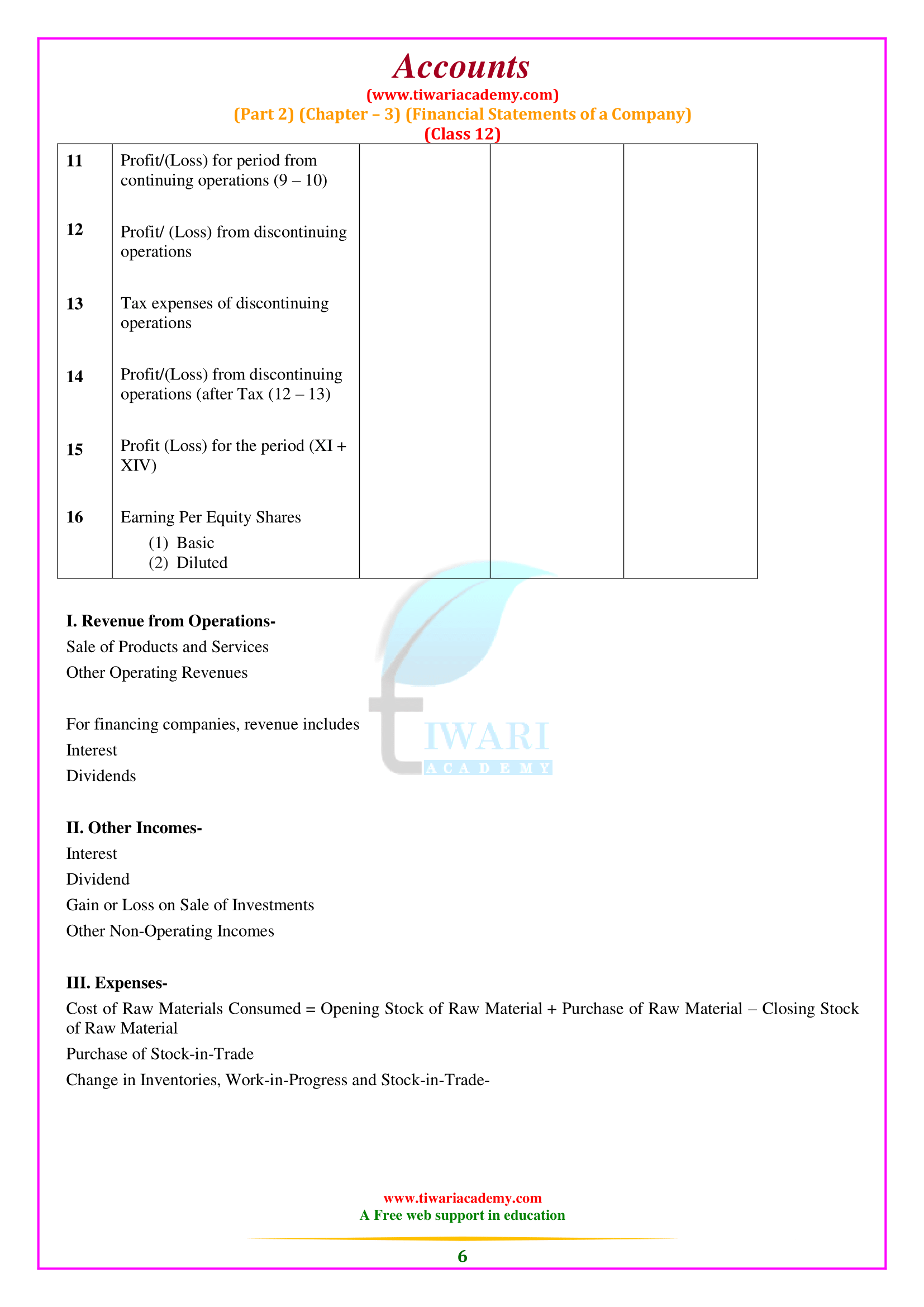

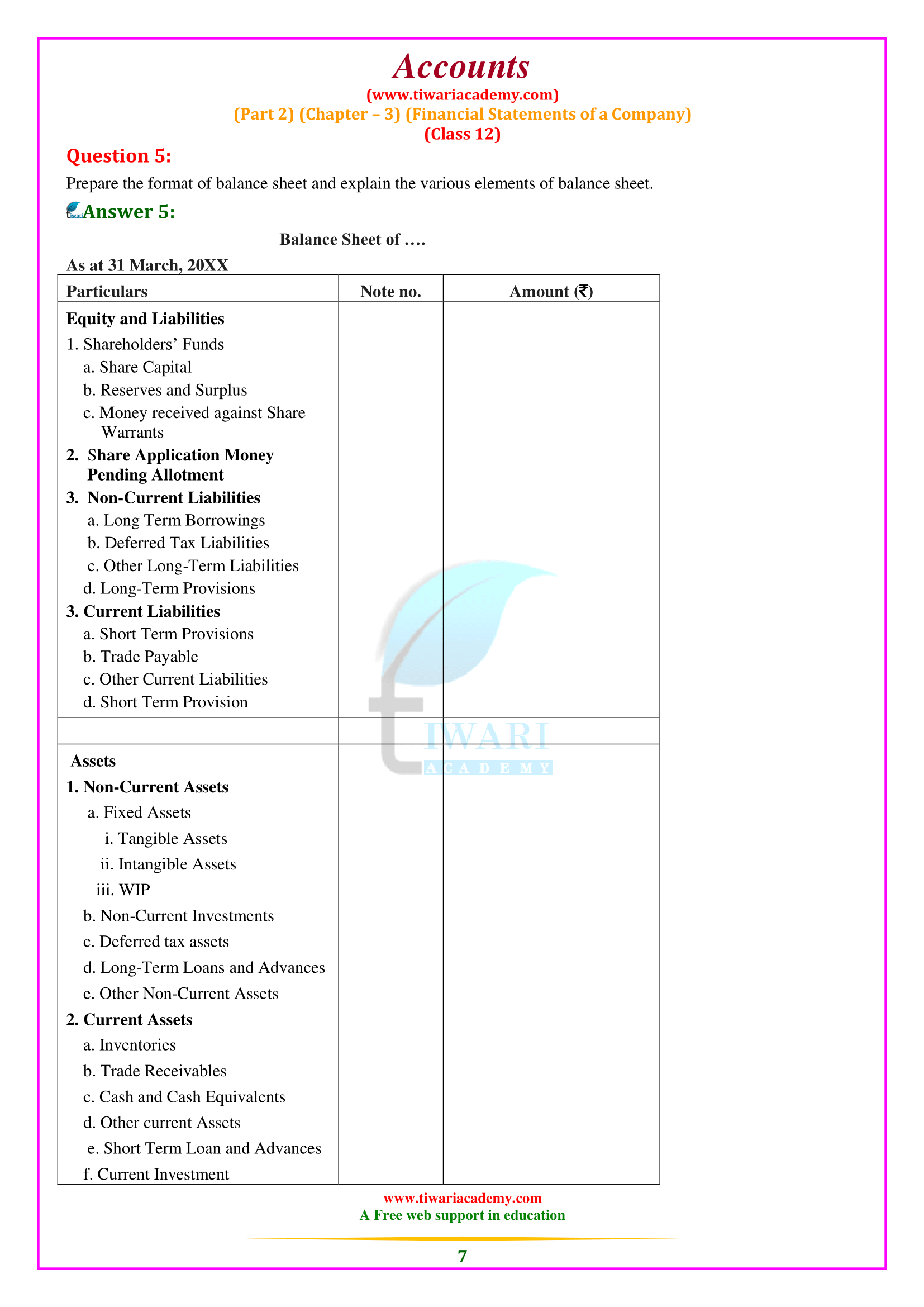

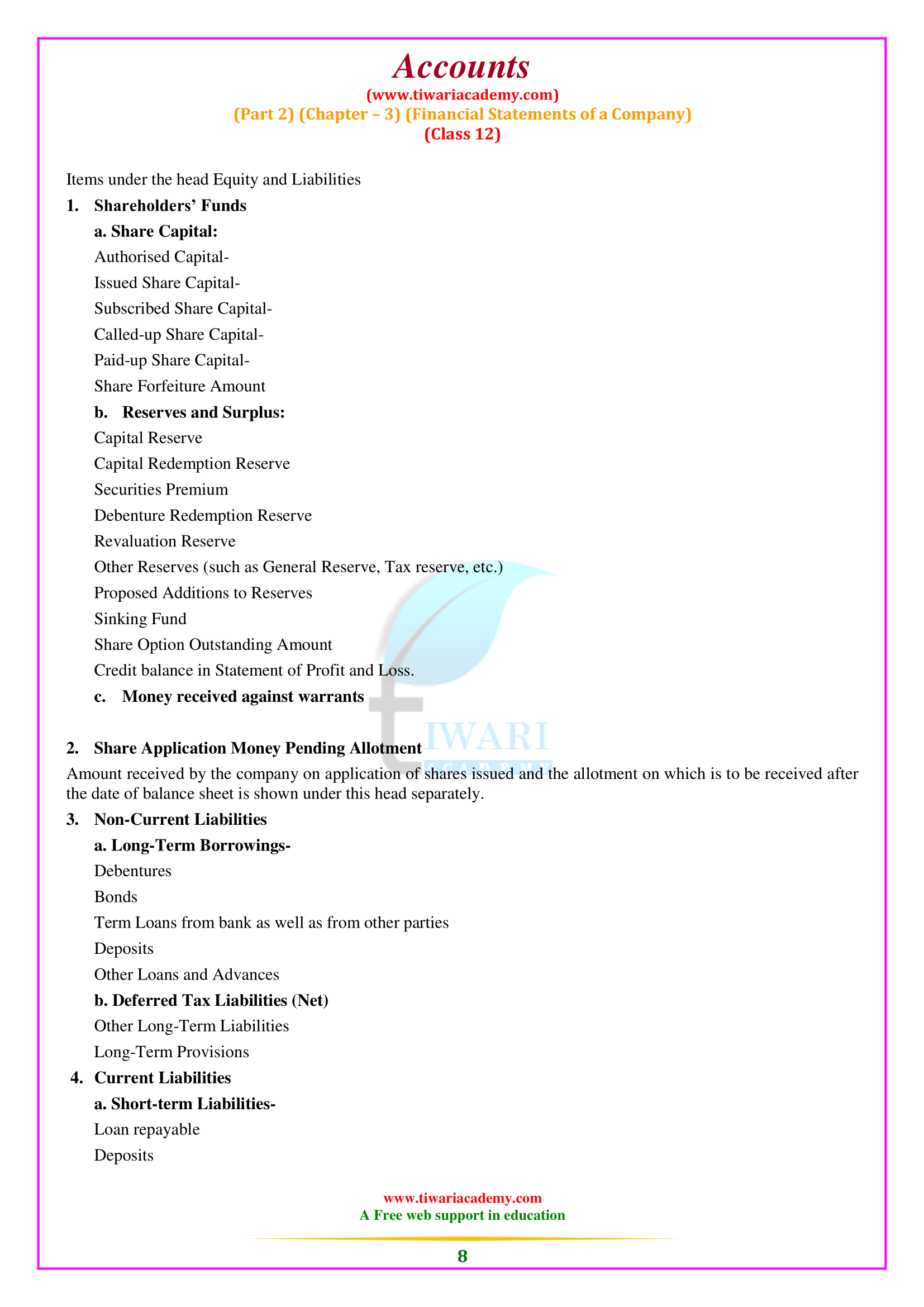

Financial statements typically include two statements: balance sheets and profit and loss statements that are required for external reporting and internal management needs such as planning, decision making, and control. It is also necessary to know the movement of funds and changes in the company’s financial position. We prepare a cash flow statement for this purpose. Each company registered under the 2013 Company Law must prepare its balance sheet, profit and loss statement, and account as per the procedure laid down in the revised Annex III of the 2013 Company Law to harmonize the disclosure requirement accounting Standards and engage with new reforms.

Objectives of Financial Statements

Financial statements are the fundamental sources of information for shareholders and other external parties to understand any business’s profitability and financial condition. They give information during a specific period of the company’s results in terms of assets and liabilities, which provide the basis for decision making. Therefore, the primary purpose of financial statements is to help users make decisions.