NCERT Solutions for Class 12 Business Studies Chapter 9 Finance Management updated for new session 2025-26 CBSE and State board. Class 12 B St Chapter 9 solutions contains all the very short questions, short answer type questions and long answers type questions.

Viva Voice for Class 12 Business Studies

NCERT Solutions for Class 12 Business Studies Chapter 9

Class 12 Business Studies Chapter 9 NCERT Solutions

Very Short Answer Type Questions

What is meant by capital structure?

It means the proportion of debt and equity used for financing the operations of business. In other words, it represents the proportion of debt capital and equity capital in the capital struct. The capital structure should be such which increase the value of equity share or maximizes the wealth of equity shareholders. Algebraically, it is debt/equity or, debt/debt+ equity.

State the two objectives of financial planning.

It helps in designing the blueprint of the financial operations of a firm. The objective of it is to ensure that enough funds are available at right time.

- To ensure availability of funds whenever these are required: This include a proper estimation of funds required for different purpose such as for the purpose of long term assets or to meet day to day expense of the business. It also tries to specify possible sources of these funds.

- To see that firm does not raise resources unnecessarily: Excess funding is almost as bad as inadequate funding. Even if there is some surplus money, good financial planning would put it to the best possible use.

Name the concept of financial management which increases the return to equity shareholders due to the presence of fixed financial charges.

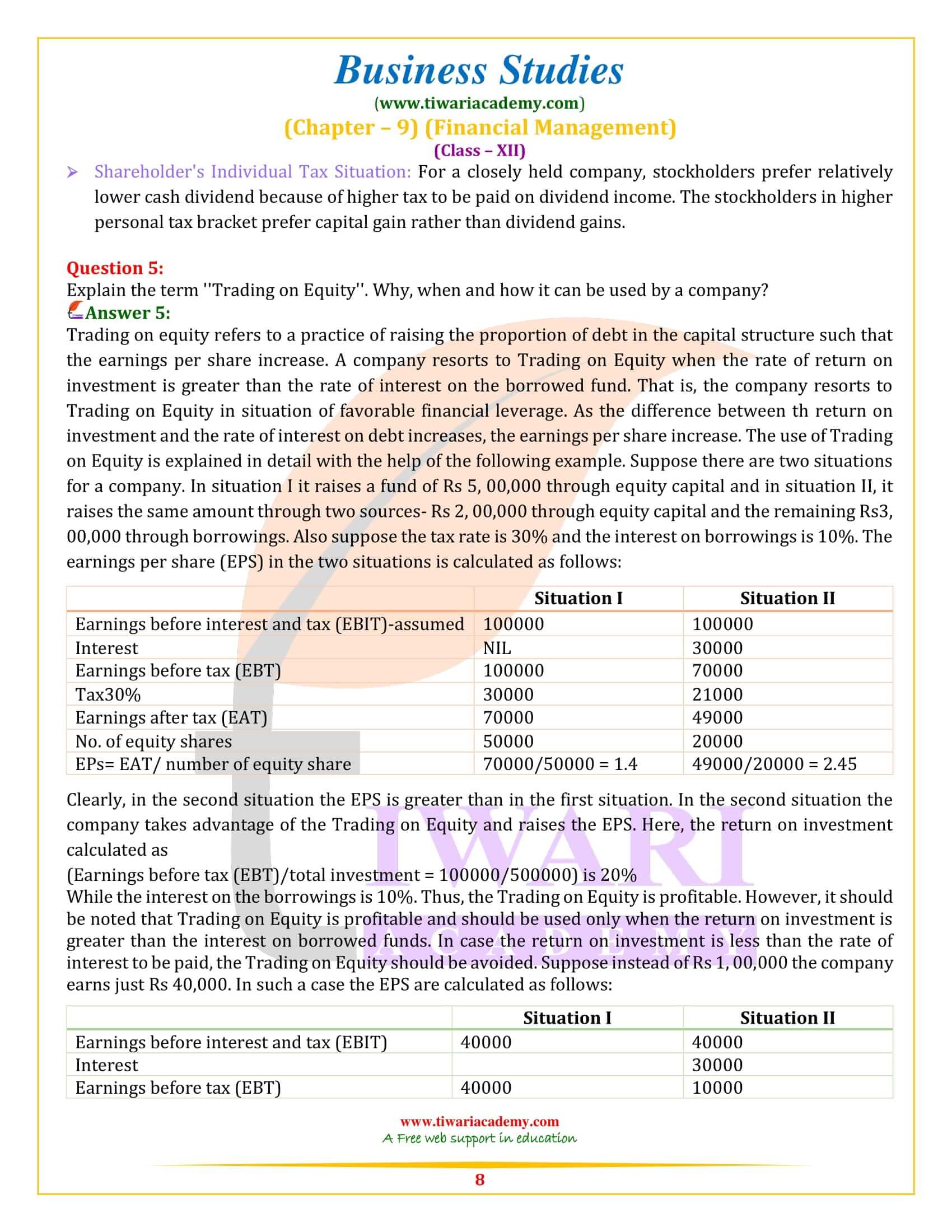

The concept of financial management which increases the return to equity shareholders due to the presence of fixed financial charges is trading on Equity. It is advisable to use trading on equity when the rate of return on investment is more than the rate of interest payable on debentures and loans.

Amrit is running a ‘transport service’ and earning good returns by providing this service to industries. Giving reason, state whether the working capital requirement of the firm will be ‘less’ or ‘more’.

In the above case Amrit is running a ‘Transport service’ which operates on larger scale, and it will require large amount of working capital. Hence, the working capital requirement of the firm will be more.

Ramnath is into the business of assembling and selling of televisions. Recently he has adopted a new policy of purchasing the components on three months credit and selling the complete product in cash. Will it affect the requirement of working capital? Give reason in support of your answer.

Working capital means the capital invested in current or working assets such as stock of materials and finished goods, accounts receivable, bills receivable, short-term securities and cash or bank balance for meeting day-to-day expenses.

In the above case Ramnath purchasing the components on three-month credit and selling the product in cash. In this situation the requirement of working capital will be reduced to the extent of credit he availed.

Short Answer Type Questions

What is financial risk? Why does it arise?

Financial risk refers to a situation when a company is not able to meet its fixed financial charges such as interest payment, preference dividend and repayment obligations. In other words, it refers to the probability that the company would not be able to meet its fixed financial obligations. It arises when the proportion of debt in the capital structure increases. This is because it is obligatory for the company to pay the interest charges on debt along with the principle amount. Thus, higher the debt, higher will be its payment obligations and thereby higher would be the chances of default on payment. Hence, higher use of debt leads to higher financial risk for the company.

Define a ‘current asset’. Give four examples of such assets.

These assets were retained in the business with the purpose to convert them into cash within a short period say, one year. Example, goods are purchased with a purpose to resell and earn profit, debtors exist convert into cash, I.e., receive the amount from them, bills receivable exist again for receiving cash against it. Some of the examples of current assets are short term investment, debtors, stocks and cash equivalents.

What are the main objectives of financial management? Briefly explain.

The financial management is generally concerned with procurement, allocation and control of financial resources of a concern. The objectives can be

- To ensure regular and adequate supply of funds to the concern.

- To ensure adequate returns to the shareholders this will depend upon the earning capacity, market price of the share, expectations of the shareholders.

- To ensure optimum funds utilization. Once the funds are procured, they should be utilized in maximum possible way at least cost.

- To ensure safety on investment, i.e., funds should be invested in safe ventures so that adequate rate of return can be achieved.

- To plan a sound capital structure-There should be sound and fair composition of capital so that a balance is maintained between debt and equity capital.

Financial management is based on three broad financial decisions. What are these?

It is concerned with the solution of three major issues of relating to financial operation to the firm. It is related to three dimensions,

Investment decision: It relates to where to invest, it means how the funds of the firm are invested in different assets. It can be both long-term as well as short term.

Financial decision: It relates to the question from where to raise funds. Raising funds from various resources will depend on decision on type of sources, period of finance, cost of finance, and returns.

Dividend decision: The manager has to take decision with regards to net profit distribution. Means how much to distribute as dividend and how much to retain .Net profit is generally divided into two:

1. Dividend for shareholders: Dividend and the rate have to be decided.

2. Retained profits: Amount of retained profits has to be finalized which will depend upon expansion and diversification plans of the enterprise.

Sunrises Ltd. dealing in readymade garments is planning to expand its business operations in order to cater to international market. For this purpose, the company needs additional `80, 00, 000 for replacing machines with modern machinery of higher production capacity. The company wishes to raise the required funds by issuing debentures. The debt can be issued at an estimated cost of 10%. The EBIT for the previous year of the company was `8, 00,000 and total capital investment was `1, 00, 00,000. Suggest whether issue of debenture would be considered a rational decision by the company. Give reason to justify your answer. (Ans. No, Cost of Debt (10%) is more than ROI which is 8%).

The cost of debt is higher than the return on investment.

Hence the issue is not justified.

How does working capital affect both the liquidity as well as profitability of a business?

Working capital of a business refers to the excess of current assets (such as cash in hand, debtors, stock, etc.) over current liabilities. Working capital affects both the liquidity as well as profitability of a business. As the amount of working capital increases, the liquidity of the business increases. However, since current assets offer low return, with the increase in working capital the profitability of the business falls. For example, an increase in the inventory of the business increases its liquidity but since the stock is kept idle, the profitability falls. On the other hand, low working capital, hinders the day to day operations of the business. Thus, the working capital should be such that a balance is maintained between the profitability and liquidity.

Long Answer Type Questions

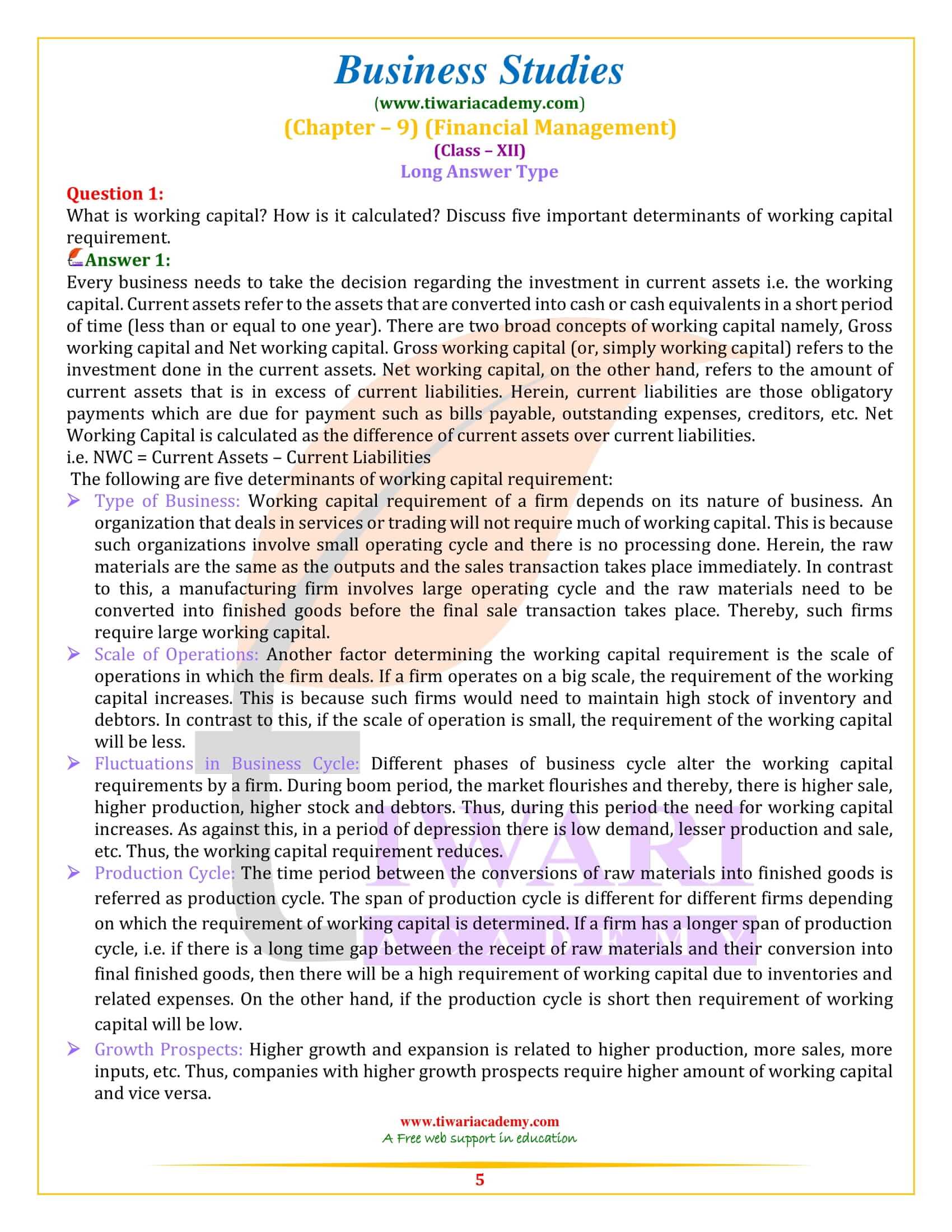

What is working capital? How is it calculated? Discuss five important determinants of working capital requirement.

Every business needs to take the decision regarding the investment in current assets i.e. the working capital. Current assets refer to the assets that are converted into cash or cash equivalents in a short period of time (less than or equal to one year). There are two broad concepts of working capital namely, Gross working capital and Net working capital. Gross working capital (or, simply working capital) refers to the investment done in the current assets. Net working capital, on the other hand, refers to the amount of current assets that is in excess of current liabilities. Herein, current liabilities are those obligatory payments which are due for payment such as bills payable, outstanding expenses, creditors, etc. Net Working Capital is calculated as the difference of current assets over current liabilities.

i.e. NWC = Current Assets – Current Liabilities

The following are five determinants of working capital requirement:

Type of Business: Working capital requirement of a firm depends on its nature of business. An organization that deals in services or trading will not require much of working capital. This is because such organizations involve small operating cycle and there is no processing done. Herein, the raw materials are the same as the outputs and the sales transaction takes place immediately. In contrast to this, a manufacturing firm involves large operating cycle and the raw materials need to be converted into finished goods before the final sale transaction takes place. Thereby, such firms require large working capital.

Scale of Operations: Another factor determining the working capital requirement is the scale of operations in which the firm deals. If a firm operates on a big scale, the requirement of the working capital increases. This is because such firms would need to maintain high stock of inventory and debtors. In contrast to this, if the scale of operation is small, the requirement of the working capital will be less.

Fluctuations in Business Cycle: Different phases of business cycle alter the working capital requirements by a firm. During boom period, the market flourishes and thereby, there is higher sale, higher production, higher stock and debtors. Thus, during this period the need for working capital increases. As against this, in a period of depression there is low demand, lesser production and sale, etc. Thus, the working capital requirement reduces.

Production Cycle: The time period between the conversions of raw materials into finished goods is referred as production cycle. The span of production cycle is different for different firms depending on which the requirement of working capital is determined. If a firm has a longer span of production cycle, i.e. if there is a long time gap between the receipt of raw materials and their conversion into final finished goods, then there will be a high requirement of working capital due to inventories and related expenses. On the other hand, if the production cycle is short then requirement of working capital will be low.

Growth Prospects: Higher growth and expansion is related to higher production, more sales, more inputs, etc. Thus, companies with higher growth prospects require higher amount of working capital and vice versa.

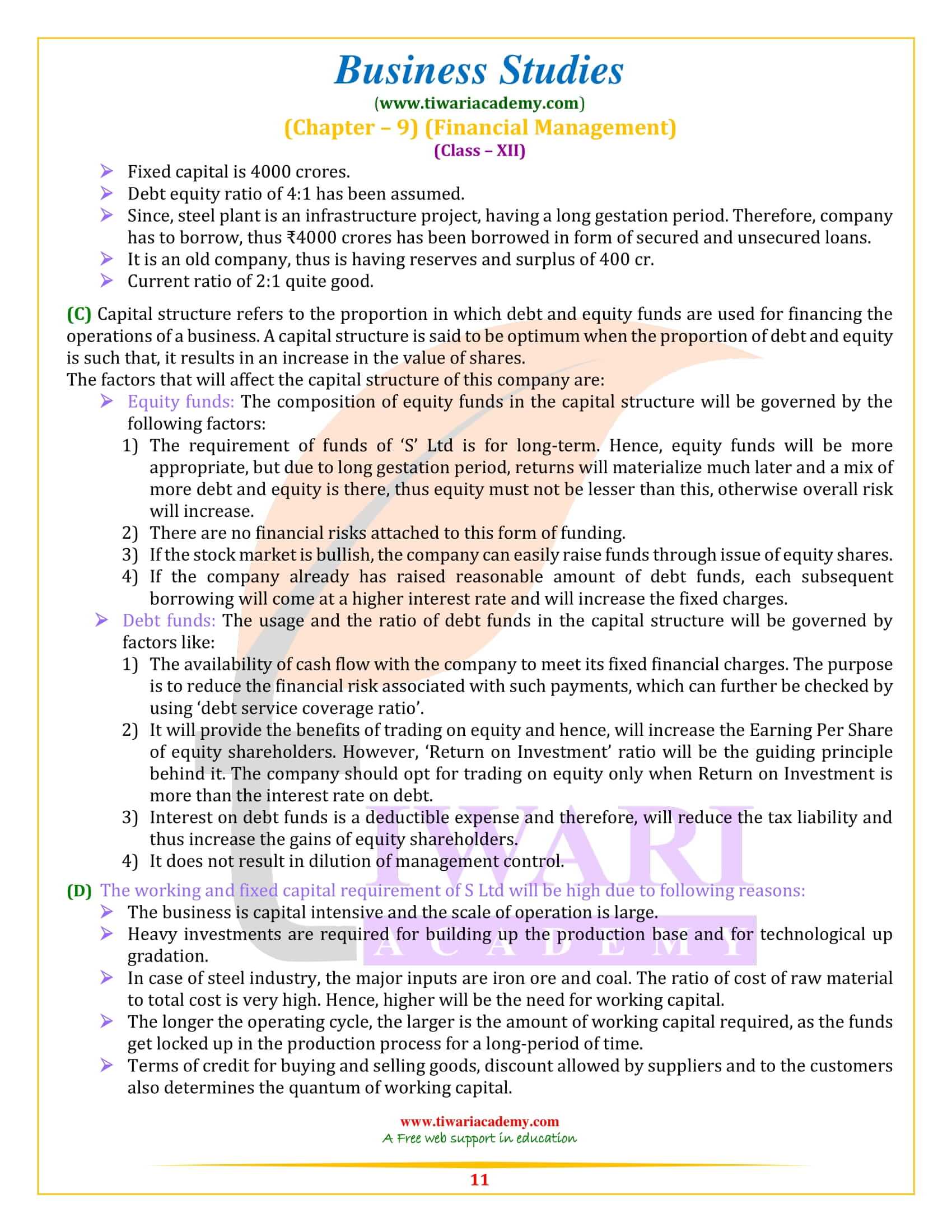

Capital structure decision is essentially optimization of risk-return relationship. Comment.

Capital Structure refers to the combination of different financial sources used by a company for raising funds. The sources of raising funds can be classified on the basis of ownership into two categories as borrowed funds and owners’ fund. Borrowed funds are in the form of loans, debentures, borrowings from banks, public deposits, etc. On the other hand, owners’ funds are in the form of reserves, preference share capital, equity share capital, retained earnings, etc. Thus, capital structure refers to the combination of borrowed funds and owners’ fund. For simplicity, all borrowed funds are referred as debt and all owners’ funds are referred as equity. Thus, capital structure refers to the combination of debt and equity to be used by the company. The capital structure used by the company depends on the risks and returns of the various alternative sources. Both debt and equity involve their respective risk and profitability considerations. While on one hand, debt is a cheaper source of finance but involves greater risk, on the other hand, although equity is comparatively expensive, they are relatively safe. The cost of debt is less because it involves low risk for lenders as they earn an assured amount of return. Thereby, they require a low rate of return which lowers the costs to the firm. In addition to this, the interest on debt is deductible from the taxable income (i.e. interest that is to be paid to the debt security holders is deducted from the total income before paying the tax). Thus, higher return can be achieved through debt at a lower cost. In contrast, raising funds through equity is expensive as it involves certain floatation cost as well. Also, the dividends are paid to the shareholders out of after tax profits. Though debt is cheaper, higher debt raises the financial risk. This is due to the fact that debt involves obligatory payments to the lenders. Any default in payment of the interest can lead to the liquidation of the firm. As against this, there is no such compulsion in case of dividend payment to shareholders. Thus, high debt is related to high financial risk. Another factor that affects the choice of capital structure is the return offered by various sources. The return offered by each source determines the value of earning per share. A high use of debt increases the earning per share of a company (this situation is called Trading on Equity). This is because debt increases the difference between Return on Investment and the cost of debt –if ROI is greater than cost of debt -and so does the EPS. Thus, there is a high return on debt. However, even though higher debt leads to higher returns but it also increases the risk to the company. Therefore, the decision regarding the capital structure should be taken very carefully, taking into consideration the return and risk involved.

Explain the factors affecting the dividend decision.

Dividend decision of a company deals with what portion of the profits is to be distributed as dividends between the shareholders and what portion is to be kept as retained earnings. The following are the factors that affect the dividend decision.

- Legal Requirements: There is no legal compulsion on the part of a company to distribute dividend. However, there are certain conditions imposed by law regarding the way dividend is distributed. Depreciation has to be provided-for example.

- Firm’s Liquidity Position: Dividend payout is also affected by firm’s liquidity position. In spite of sufficient retained earnings, the firm may not be able to pay cash dividend if the earnings are not held in cash.

- Repayment Need: A firm uses several forms of debt financing to meet its investment needs. This debt must be repaid at the maturity. If the firm has to retain its profits for the purpose of repaying debt, the dividend payment capacity reduces.

- Expected Rate Of Return: If a firm has relatively higher expected rate of return on the new investment, the firm prefers to retain the earnings for reinvestment rather than distributing cash dividend.

- Stability of Earning: If a firm has relatively stable earnings, it is likely to pay relatively larger dividend than a firm with relatively fluctuating earnings.

- Desire to Control: When the needs for additional financing arise, the management of the firm may not prefer to issue additional common stock/equity shares because of the fear of dilution in control on management. Therefore, a firm prefers to retain more earnings to satisfy additional financing need which reduces dividend payment capacity.

- Access to the Capital Market: If a firm has easy access to capital markets in raising additional financing, it does not require more retained earnings. So a firm’s dividend payment capacity becomes high.

- Shareholder’s Individual Tax Situation: For a closely held company, stockholders prefer relatively lower cash dividend because of higher tax to be paid on dividend income. The stockholders in higher personal tax bracket prefer capital gain rather than dividend gains.

FAQs

Does financial management mean management of finance as per chpater 9 of 12 Business Studies?

Yes, it also means taking three important decisions namely financing decision, investment decision and dividend decision.

What is a peculiar feature of chapter 9 financial management in 12 B. St.?

Most of the answers in this chapter are lengthy and contain anywhere between 8 to 12 points each. For detailed notes and answers you are invited to Tiwari Academy’s website.

How do we master chapter 9 of Class 12 Business Studies?

Since, this chapter is quite technical in nature and quite lengthy, points should memorized and practice should be done in writing. Further, it should be noted that in questions relating to factors affecting fixed capital management and working capital management, at least three points are similar.