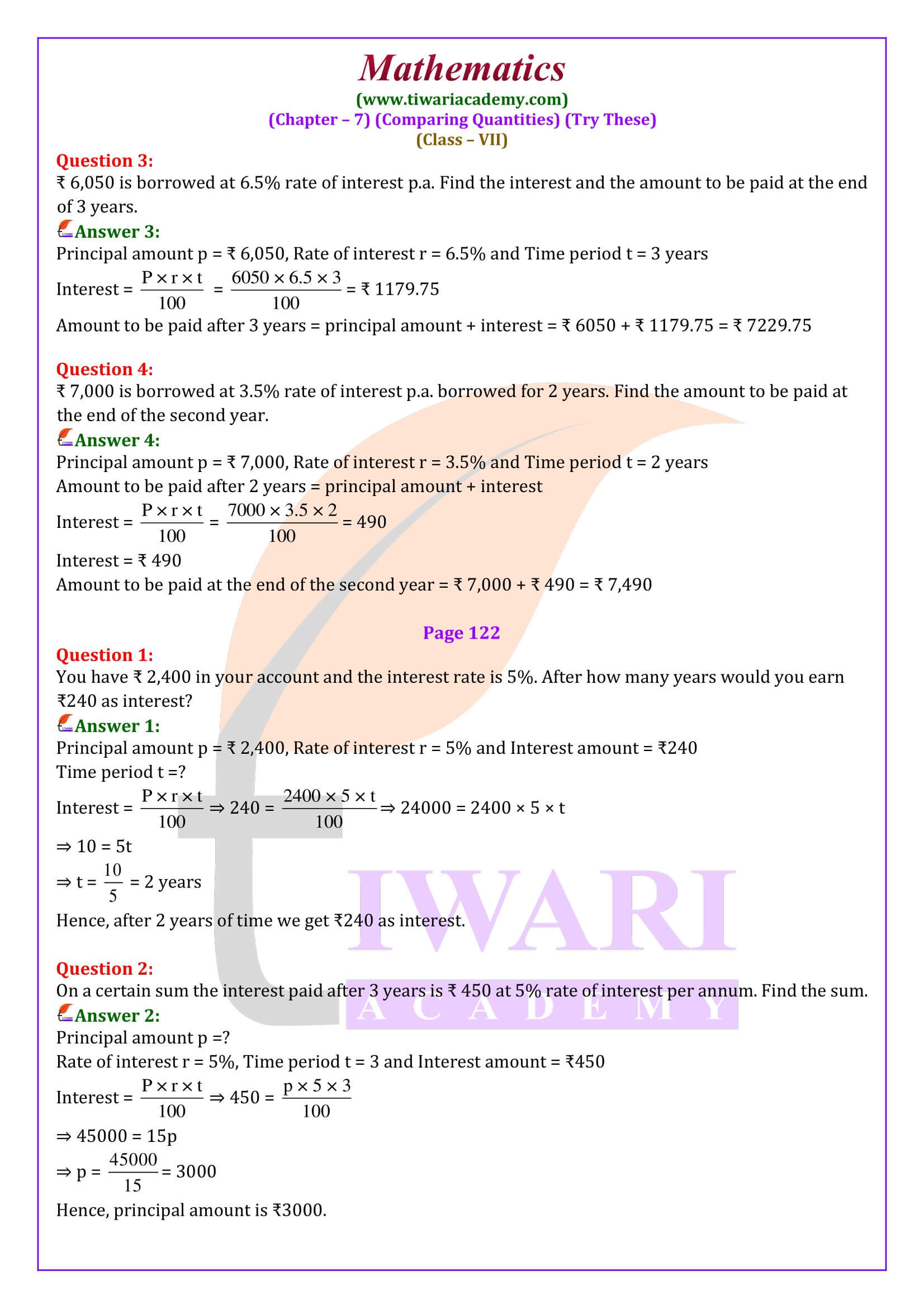

NCERT Solutions for Class 7 Maths Chapter 7 Comparing Quantities and Class 7 Maths Chapter 7 Try These Solutions in Hindi and English Medium updated for new session 2024-25. Get the revised solutions of chapter 7 of 7th mathematics. NCERT Class 7 Maths Chapter 7 Comparing Quantities deals with topics related to ratios, proportions, and percentages. To make this chapter simpler and easier to understand, follow and Try These Solutions. According to new NCERT textbook, there are only two exercises in chapter 7 of 7th Maths.

7th Maths Chapter 7 Solutions in English Medium

7th Maths Chapter 7 Solutions in Hindi Medium

| Class: 7 | Mathematics |

| Chapter 7: | Comparing Quantities |

| Number of Exercises: | 2 (Two) |

| Content: | NCERT Exercises and Try These Solutions |

| Mode: | Online Text, Images and Videos |

| Academic Session: | 2024-25 |

| Medium: | English and Hindi Medium |

NCERT Solutions for Class 7 Maths Chapter 7

7th Maths Exercise 7.1 and Exercise 7.2 in English Medium or Prashnavali 7.1 aur 7.2 in Hindi Medium. All the NCERT (https://ncert.nic.in/) Textbook solutions are free to study online or download in PDF file format. Start by reading the chapter from your textbook. Pay attention to explanations, examples, and solved problems. Make sure you understand the concepts of ratios, proportions, and percentages. These concepts form the foundation for comparing quantities. Solutions are updated according to new CBSE Syllabus. Questions are taken from the NCERT Books 2024-25 released for CBSE new academic session. Relate the concepts to real-life situations. For example, use examples from shopping, recipes, or any scenario where quantities are compared.

Important Questions on Class 7 Maths Chapter 7

Find the ratio of ₹5 to 50 paise.

₹5 to 50 paise

= 5 x 100 paise to 50 paise [₹ 1 = 100 paise]

= 500 paise to 50 paise

Thus, the ratio = 500/50 = 10 : 1

I buy a T.V. for ₹10,000 and sell it at a profit of 20%. How much money do I get for it?

The cost price of T.V. = ₹ 10,000

Profit percent = 20%

Now,

Profit = Profit% of C.P. = 20/100 x 1000 = ₹ 2,000

Selling price = C.P. + Profit = ₹10,000 + ₹2,000 = ₹ 12,000

Hence, he gets ₹12,000 on selling his T.V.

7 Maths Chapter 7 Solutions

Use visual aids like diagrams or drawings to help you understand and visualize ratios. Class 7 Maths Chapter 7 Exercise 7.1 and Ex. 7.2 of Comparing Quantities with complete description of each question are given below. Begin with simple ratios before moving to more complex ones. Practice solving problems that involve finding the ratio of quantities. NCERT Solutions are updated for the new session 2024-25. Study the concept of proportions. Learn how to solve problems involving direct and inverse proportions. Work through the example problems given in the textbook. These problems illustrate how to apply the concepts in various scenarios.

About NCERT Solutions for Class 7 Maths Chapter 7

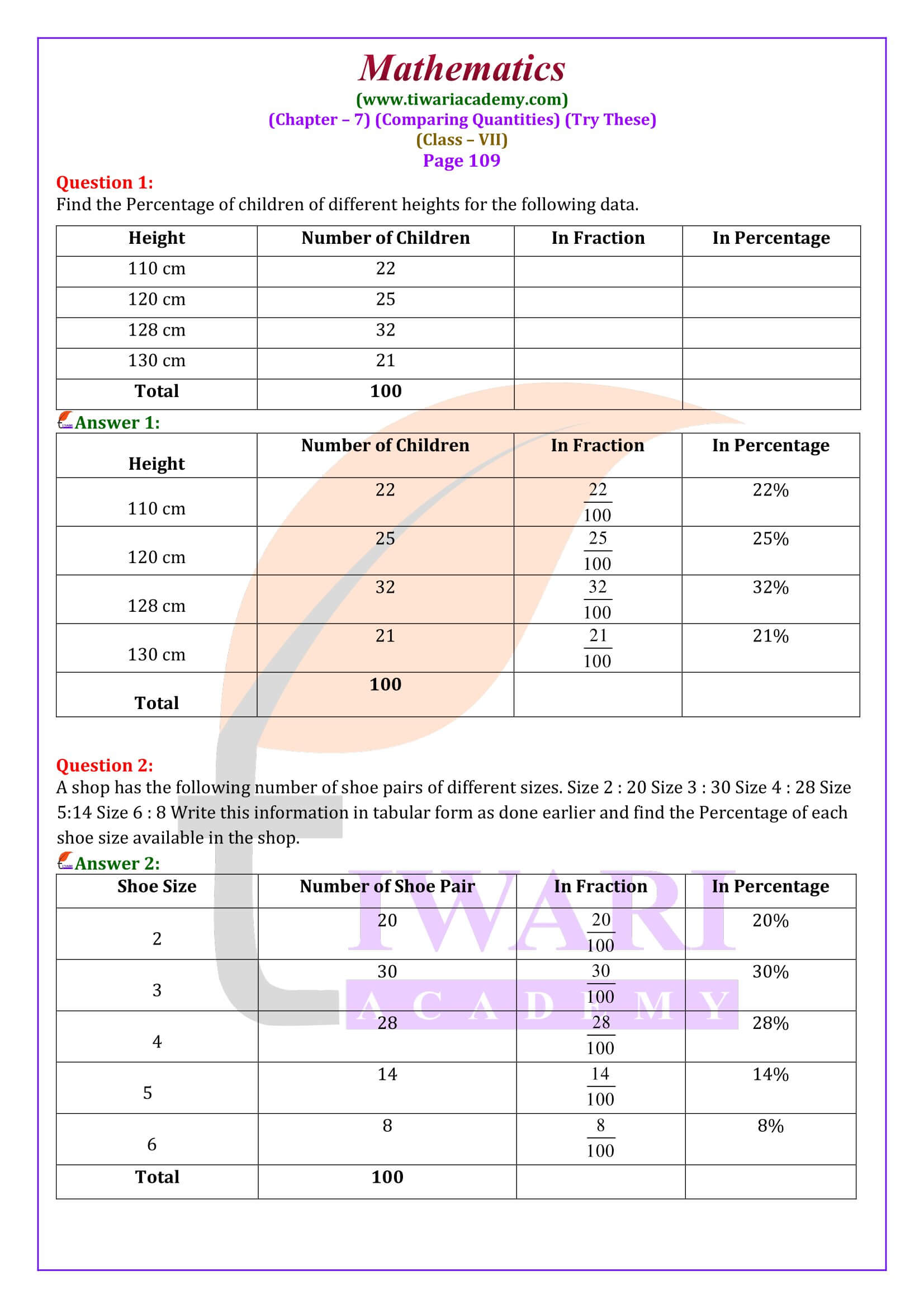

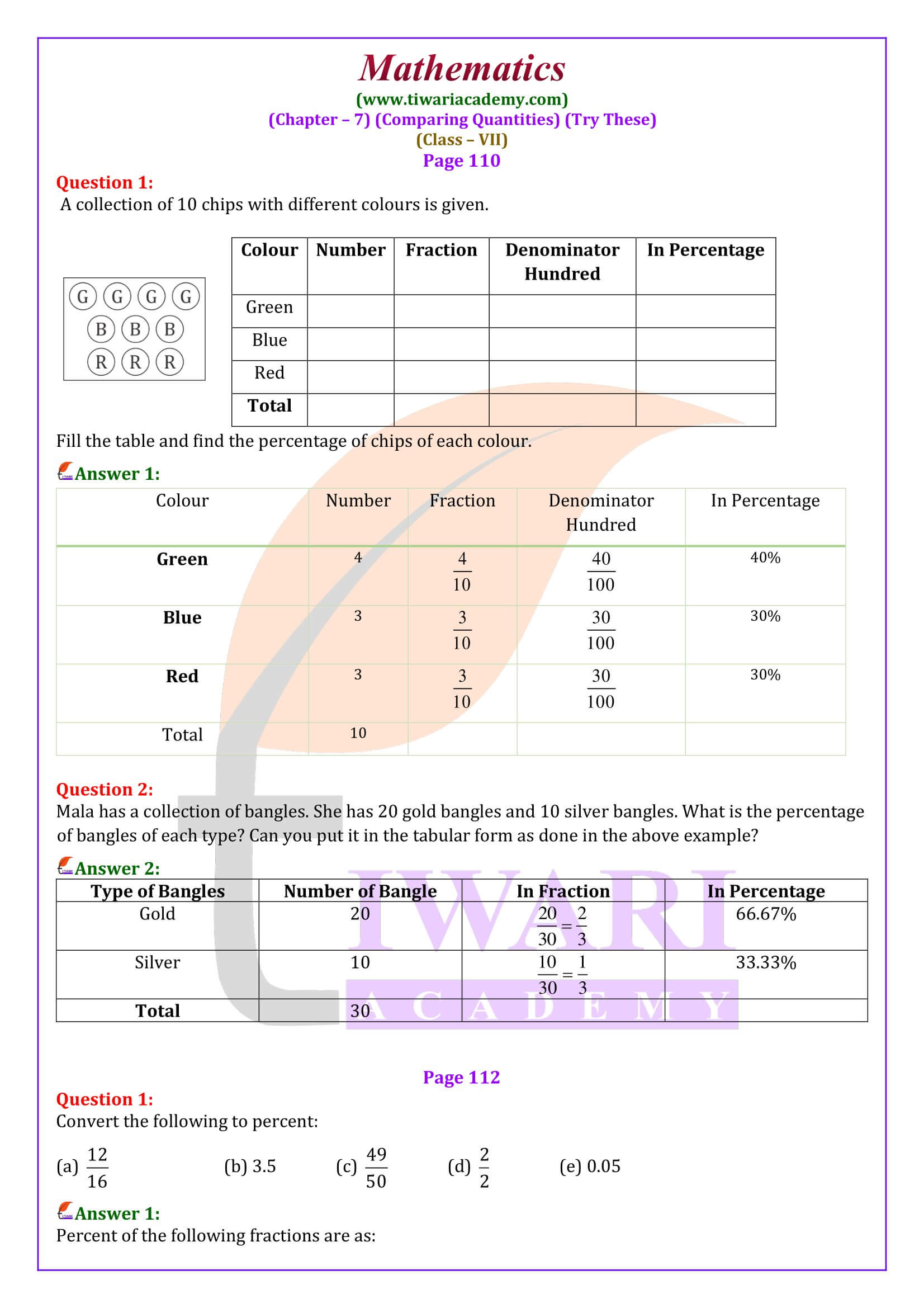

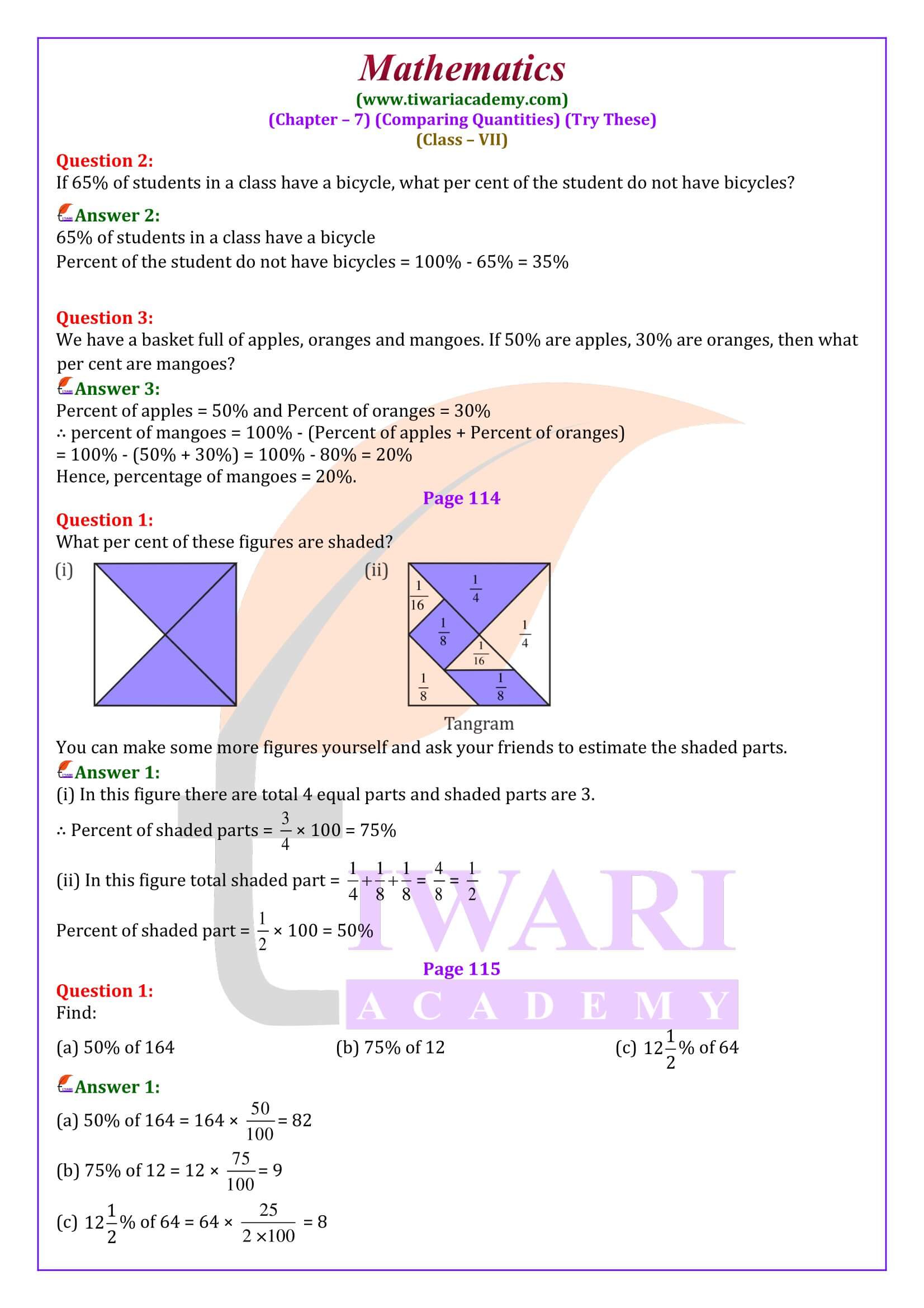

In 7 Mathematics Chapter 7 Comparing Quantities, we will study actually ratio and proportions in practical life. Some time we need to convert numbers into percentage. Percentages are numerators of fractions with denominator 100. Per cent is derived from Latin word ‘per centum’ meaning ‘per hundred’. Percentage when the total does not add to give 100. In the case, we multiply the fraction by 100/100. This does not change the value of the fraction. Subsequently, only 100 remains in the denominator. In this chapter we practice the questions based on –

1. Converting fraction into percent and vice versa.

2. Converting decimal into percent and vice versa.

3. Converting ratio into percent and percent into ratio also.

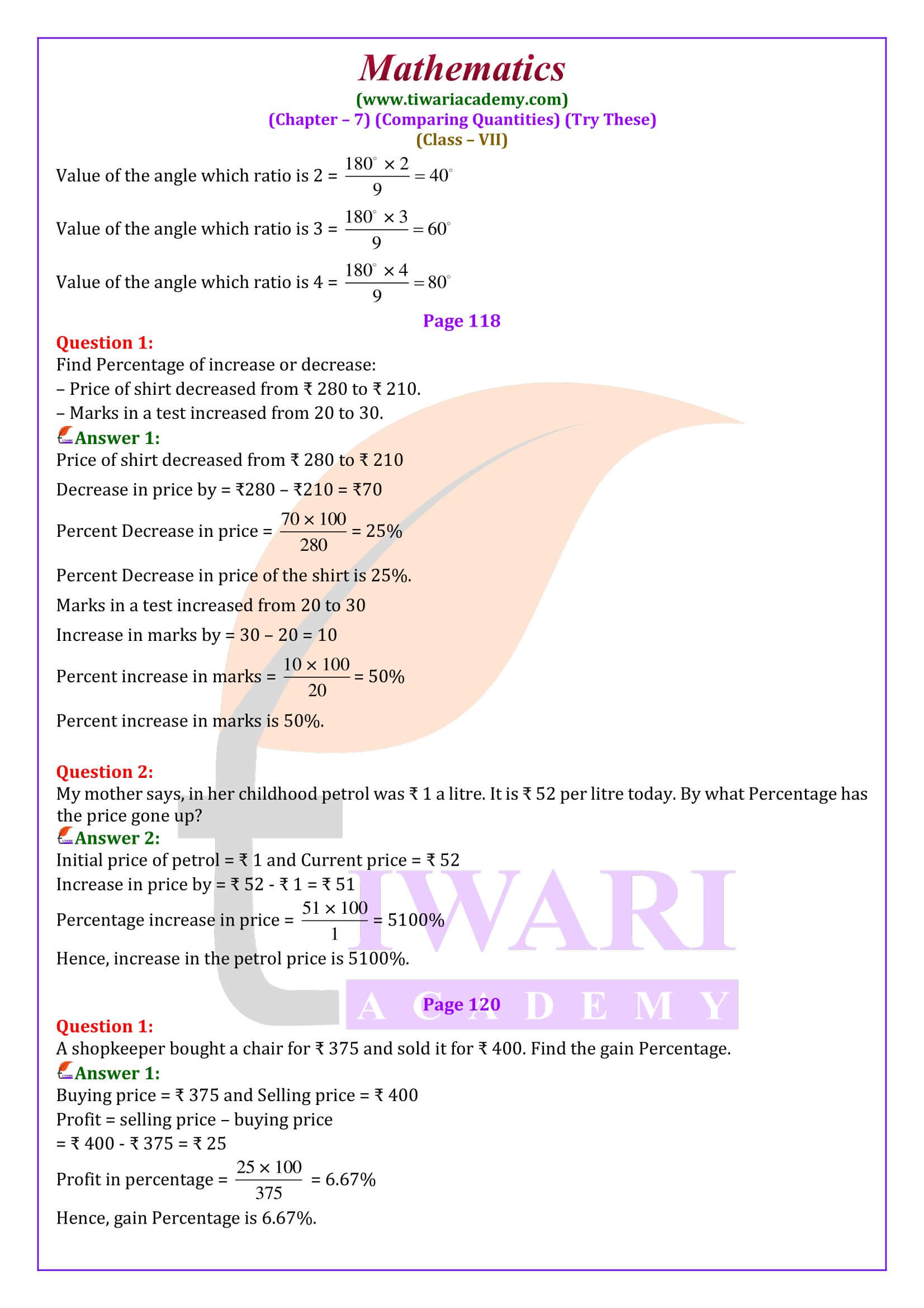

On the basis of percent, we can find the increase percent or decrease percent in any commodity to check the increase the cost percentage. The concepts of Cost price, Selling Price, Discount, Profit, Loss, etc. are based on the application of percentage. Simple Interest and Compound Interest are also the application in percentage.

1. The increase or decrease in a certain quantity can also be expressed as percentage.

2. When parts of a quantity are given to us as ratios, we have seen how to convert them to percentages.

Practice of Class 7 Maths Chapter 7

Practice with Percentages: Understand the concept of percentages and practice converting fractions and decimals to percentages and vice versa.

Solve Percentage Problems: Practice solving problems that involve calculating percentages of quantities, such as discounts, profit, and interest.

Use Ratios in Context: Apply ratios and proportions to solve real-world problems, such as scaling up recipes, calculating distances, or mixing solutions.

Work on Word Problems: Solve word problems that involve comparing quantities, percentages, and proportions. Focus on translating the problem into mathematical equations.

Use Online Resources: Look for online tutorials, videos, and interactive resources that explain and demonstrate these concepts. Create flashcards with ratios, proportions, and percentage conversions on one side and the corresponding solutions on the other.

Discuss with Peers: Collaborate with classmates to discuss concepts, solve problems together, and clarify doubts. Regularly review and revision to reinforce the understanding. This helps prevent forgetting important concepts.

Practice with Old Question Papers: Solve questions from previous years’ question papers or sample papers. This can help you become familiar with the type of questions asked in exams. If you’re struggling with specific concepts, don’t hesitate to ask your teacher or peers for assistance.

By breaking down the chapter into manageable sections, practicing consistently, and seeking help when needed, you can make NCERT Class 7 Maths Chapter 7 more approachable and easier to grasp.